Simple Bollinger Bands

来源;https://uqer.io/community/share/54b5c1b4f9f06c276f651a15

策略思路: 在一段时间内,股票价格可以认为是在一定水平上下波动。例如,可以简单认为股价在过去100天的平均值基础上,上下波动几个标准差。

策略实现: (1) 股价高于这个波动区间,说明股价虚高,故卖出 (2) 股价低于这个波动区间,说明股价虚低,故买入

PS:本策略适用于股市平稳波动时期,在大牛市或者大熊市不太适用

import quartz

import quartz.backtest as qb

import quartz.performance as qp

from quartz.api import *

import pandas as pd

import numpy as np

from datetime import datetime

from matplotlib import pylab

import talib

start = datetime(2011, 1, 1)

end = datetime(2014, 10, 1)

benchmark = 'HS300'

universe = ['601398.XSHG', '600028.XSHG', '601988.XSHG', '600036.XSHG', '600030.XSHG',

'601318.XSHG', '600000.XSHG', '600019.XSHG', '600519.XSHG', '601166.XSHG']

capital_base = 1000000

refresh_rate = 5

window = 200

def initialize(account):

account.amount = 10000

account.universe = universe

add_history('hist', window)

def handle_data(account):

for stk in account.universe:

prices = account.hist[stk]['closePrice']

if prices is None:

return

mu = prices.mean()

sd = prices.std()

upper = mu + 2*sd

middle = mu

lower = mu - 2*sd

cur_pos = account.position.stkpos.get(stk, 0)

cur_prc = prices[-1]

if cur_prc > upper and cur_pos >= 0:

order_to(stk, 0)

if cur_prc < lower and cur_pos <= 0:

order(stk, account.amount)

bt

| tradeDate | cash | stock_position | portfolio_value | benchmark_return | blotter | |

|---|---|---|---|---|---|---|

| 0 | 2011-11-01 | 1000000.00000 | {} | 1000000.00000 | 0.000000 | [] |

| 1 | 2011-11-02 | 1000000.00000 | {} | 1000000.00000 | 0.016629 | [] |

| 2 | 2011-11-03 | 1000000.00000 | {} | 1000000.00000 | 0.000697 | [] |

| 3 | 2011-11-04 | 1000000.00000 | {} | 1000000.00000 | 0.007086 | [] |

| 4 | 2011-11-07 | 1000000.00000 | {} | 1000000.00000 | -0.009950 | [] |

| 5 | 2011-11-08 | 1000000.00000 | {} | 1000000.00000 | -0.003120 | [] |

| 6 | 2011-11-09 | 1000000.00000 | {} | 1000000.00000 | 0.008778 | [] |

| 7 | 2011-11-10 | 1000000.00000 | {} | 1000000.00000 | -0.018922 | [] |

| 8 | 2011-11-11 | 1000000.00000 | {} | 1000000.00000 | -0.001699 | [] |

| 9 | 2011-11-14 | 1000000.00000 | {} | 1000000.00000 | 0.020480 | [] |

| 10 | 2011-11-15 | 1000000.00000 | {} | 1000000.00000 | -0.002005 | [] |

| 11 | 2011-11-16 | 1000000.00000 | {} | 1000000.00000 | -0.027167 | [] |

| 12 | 2011-11-17 | 1000000.00000 | {} | 1000000.00000 | -0.003033 | [] |

| 13 | 2011-11-18 | 1000000.00000 | {} | 1000000.00000 | -0.020857 | [] |

| 14 | 2011-11-21 | 1000000.00000 | {} | 1000000.00000 | 0.001225 | [] |

| 15 | 2011-11-22 | 1000000.00000 | {} | 1000000.00000 | -0.000081 | [] |

| 16 | 2011-11-23 | 1000000.00000 | {} | 1000000.00000 | -0.009758 | [] |

| 17 | 2011-11-24 | 1000000.00000 | {} | 1000000.00000 | 0.001898 | [] |

| 18 | 2011-11-25 | 1000000.00000 | {} | 1000000.00000 | -0.007317 | [] |

| 19 | 2011-11-28 | 1000000.00000 | {} | 1000000.00000 | 0.001303 | [] |

| 20 | 2011-11-29 | 1000000.00000 | {} | 1000000.00000 | 0.013697 | [] |

| 21 | 2011-11-30 | 1000000.00000 | {} | 1000000.00000 | -0.033370 | [] |

| 22 | 2011-12-01 | 1000000.00000 | {} | 1000000.00000 | 0.024625 | [] |

| 23 | 2011-12-02 | 1000000.00000 | {} | 1000000.00000 | -0.010180 | [] |

| 24 | 2011-12-05 | 1000000.00000 | {} | 1000000.00000 | -0.014048 | [] |

| 25 | 2011-12-06 | 1000000.00000 | {} | 1000000.00000 | -0.002000 | [] |

| 26 | 2011-12-07 | 1000000.00000 | {} | 1000000.00000 | 0.004724 | [] |

| 27 | 2011-12-08 | 1000000.00000 | {} | 1000000.00000 | -0.001276 | [] |

| 28 | 2011-12-09 | 1000000.00000 | {} | 1000000.00000 | -0.008531 | [] |

| 29 | 2011-12-12 | 1000000.00000 | {} | 1000000.00000 | -0.010293 | [] |

| ... | ... | ... | ... | ... | ... | ... |

| 679 | 2014-08-19 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1149017.27989 | 0.000087 | [] |

| 680 | 2014-08-20 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1168551.04989 | -0.003633 | [Order({'transact_price': 0.0, 'symbol': '6000... |

| 681 | 2014-08-21 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1155719.88989 | -0.005028 | [] |

| 682 | 2014-08-22 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1152026.33989 | 0.004723 | [] |

| 683 | 2014-08-25 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1148250.45989 | -0.009513 | [] |

| 684 | 2014-08-26 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1141866.53989 | -0.008012 | [] |

| 685 | 2014-08-27 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1133729.60989 | 0.001507 | [] |

| 686 | 2014-08-28 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1130309.43989 | -0.007010 | [] |

| 687 | 2014-08-29 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1144849.97989 | 0.011686 | [] |

| 688 | 2014-09-01 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1146127.24989 | 0.007283 | [] |

| 689 | 2014-09-02 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1171994.81989 | 0.013222 | [] |

| 690 | 2014-09-03 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1186363.06989 | 0.009377 | [Order({'transact_price': 0.0, 'symbol': '6000... |

| 691 | 2014-09-04 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1188453.82989 | 0.007218 | [] |

| 692 | 2014-09-05 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1203626.03989 | 0.009494 | [] |

| 693 | 2014-09-09 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1182303.76989 | -0.001647 | [] |

| 694 | 2014-09-10 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1180321.58989 | -0.005231 | [] |

| 695 | 2014-09-11 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1168537.55989 | -0.003691 | [Order({'transact_price': 0.0, 'symbol': '6000... |

| 696 | 2014-09-12 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1171787.86989 | 0.006150 | [] |

| 697 | 2014-09-15 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1153269.96989 | -0.000479 | [] |

| 698 | 2014-09-16 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1141194.90989 | -0.019869 | [] |

| 699 | 2014-09-17 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1145778.58989 | 0.005258 | [] |

| 700 | 2014-09-18 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1152235.30989 | 0.003056 | [] |

| 701 | 2014-09-19 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1162000.35989 | 0.006870 | [] |

| 702 | 2014-09-22 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1136441.48989 | -0.019087 | [] |

| 703 | 2014-09-23 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1139988.07989 | 0.008635 | [] |

| 704 | 2014-09-24 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1157613.46989 | 0.017671 | [] |

| 705 | 2014-09-25 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1169367.30989 | -0.002006 | [] |

| 706 | 2014-09-26 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1169791.29989 | 0.000094 | [] |

| 707 | 2014-09-29 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1170503.49989 | 0.004349 | [] |

| 708 | 2014-09-30 | 96907.47989 | {u'601166.XSHG': 3877.0, u'600036.XSHG': 0, u'... | 1168692.07989 | 0.001303 | [] |

709 rows × 6 columns

perf = qp.perf_parse(bt)

out_keys = ['annualized_return', 'volatility', 'information',

'sharpe', 'max_drawdown', 'alpha', 'beta']

for k in out_keys:

print '%s: %s' % (k, perf[k])

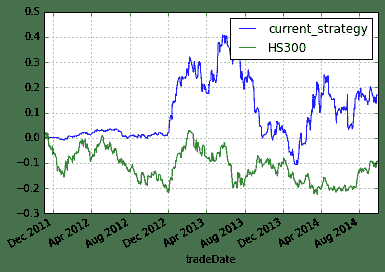

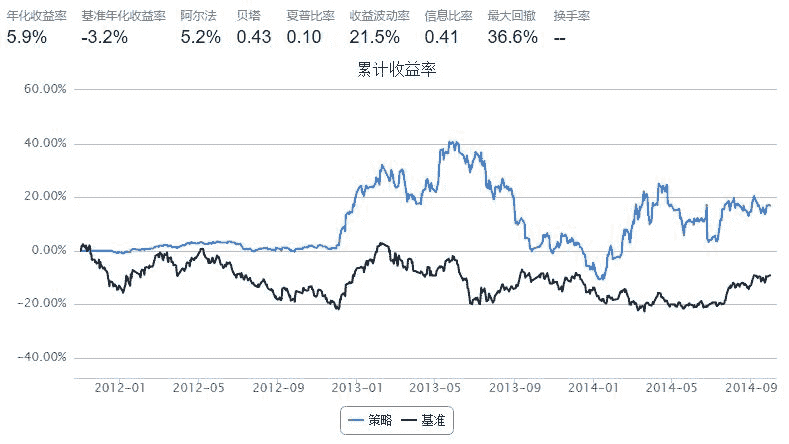

annualized_return: 0.0594823977045

volatility: 0.214571802928

information: 0.407163653335

sharpe: 0.102806600884

max_drawdown: 0.36585509048

alpha: 0.052294592526

beta: 0.434097117249

perf['cumulative_return'].plot()

perf['benchmark_cumulative_return'].plot()

pylab.legend(['current_strategy','HS300'])

<matplotlib.legend.Legend at 0x568fe90>