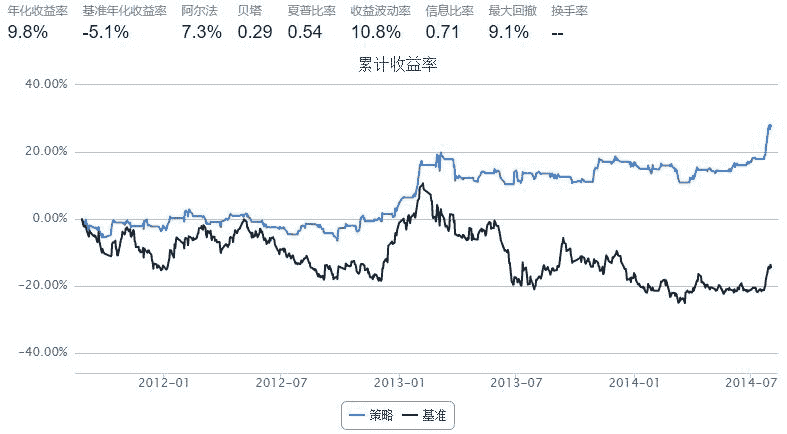

9.2 GMVP · Global Minimum Variance Portfolio (GMVP)

来源:https://uqer.io/community/share/55461734f9f06c1c3d688030

import pandas as pd

import numpy as np

start = '2011-07-01' # 回测起始时间

end = '2014-08-01' # 回测结束时间

benchmark = 'SH50' # 策略参考标准

universe = ['601398.XSHG','600028.XSHG', '601988.XSHG', '600036.XSHG','600030.XSHG','601318.XSHG', '600000.XSHG', '600019.XSHG', '600519.XSHG', '601166.XSHG']

capital_base = 100000 # 起始资金

longest_history = 40 # handle_data 函数中可以使用的历史数据最长窗口长度

refresh_rate = 10 # 调仓频率,即每 refresh_rate 个交易日执行一次 handle_data() 函数

def initialize(account): # 初始化虚拟账户状态

pass

def handle_data(account): # 每个交易日的买入卖出指令

history_data = account.get_attribute_history('closePrice',40)

retmatrix = []

for s in account.universe:

retmatrix.append([history_data[s][i]/ history_data[s][i - 1] for i in range(1,40) ])

retmatrix = np.array(retmatrix)

covmatrix = np.cov(retmatrix, y=None, rowvar=1, bias=0, ddof=None)

covmatrix = np.matrix(covmatrix) # 不加这句执行矩阵求逆报错

covinv = np.linalg.inv(covmatrix)

one_row = np.matrix(np.ones(len(account.universe)))

one_vector = np.matrix(np.ones(len(account.universe))).transpose()

up = np.dot(covinv, one_vector)

down = np.dot(np.dot(one_row, covinv), one_vector)

weights = up/down

weightsum = 0

for a in weights:

weightsum += a

index= 0

for s in account.universe:

weigh = weights[index]/weightsum

index = index + 1

amount = account.cash * weigh / account.referencePrice[s]

order_to(s,amount)

just implement the examples in the API doc