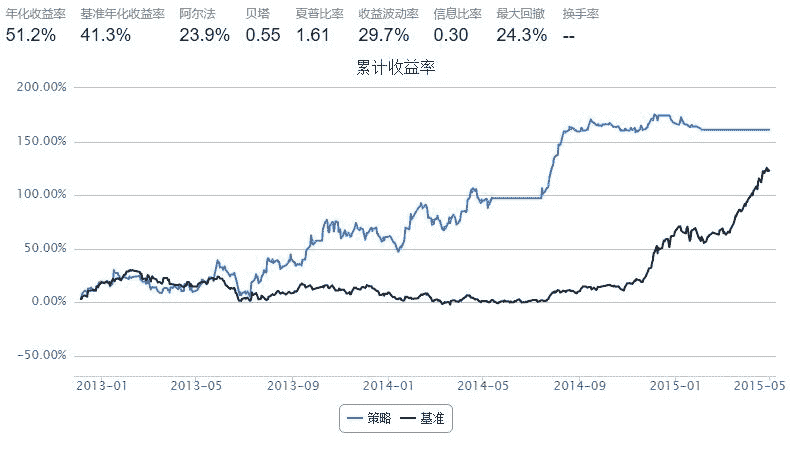

5.10 PAMR · PAMR : 基于均值反转的投资组合选择策略 - 修改版

来源:https://uqer.io/community/share/55a4c52bf9f06c6dd3e17f0f

策略思路:

该策略的主要思想是用一个损失函数反映均值反转性质,即如果基于前一期相对价格的预期收益值大于一定阈值,损失值将线性增长;否则,损失为0

策略实现

m个资产每日调仓:对每个资产,收益高于总资产平均收益者,减持;收益低于总资产平均收益者,增持

具体参见文献: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.421.579&rep=rep1&type=pdf

from CAL.PyCAL import *

from numpy import *

import pandas as pd

import numpy as np

from pandas import DataFrame

import cvxopt

from cvxopt import matrix

from cvxopt.blas import dot

import cvxopt.solvers as cs

# parameters used in updatePAMR

sensitivity = 0.8

C = 600

start = datetime(2012, 12, 1)

end = datetime(2015, 5, 1)

benchmark = 'HS300'

universe = set_universe('SH180')

capital_base = 1e8

refresh_rate = 1

window = 1

tickers = [stk[0:6] for stk in universe]

portfolio = DataFrame(1.0, index = universe, columns = ['prePosition', 'position', 'relative_price'])

def initialize(account):

account.amount = capital_base

account.universe = universe

account.days = 0

def handle_data(account):

today = account.current_date

today_str = today.strftime("%Y%m%d")

for stk in universe:

hist_close = account.get_attribute_history('closePrice', 2)

hist_pre_close = account.get_attribute_history('preClosePrice', 2)

try:

portfolio['relative_price'][stk] = hist_close[stk][-1]/hist_pre_close[stk][-1]

#print stk, today_str, portfolio['relative_price'][stk]

except:

continue

portfolio['relative_price'] = portfolio['relative_price'].fillna(1.0)

portfolio['prePosition'] = portfolio['position']

a = portfolio['prePosition']

b = portfolio['relative_price']

portfolio['position'] = normalizePortfolio(updatePAMR(a, b, sensitivity, C))

for stk in portfolio.index:

try:

stk_amount = capital_base*portfolio['position'][stk]/hist_close[stk][-1]

order_to(stk, stk_amount)

except:

continue

def lossFunction(portfolio, relative_price, sensitivity):

# define a e-insensitive loss function

# portfolio vector: b

# price relative vector: x

# sensitivity parameter: e

# then: loss = max(0, dot(x,b) - e)

portfolio_return = portfolio.transpose().dot(relative_price)

if portfolio_return < sensitivity:

return 0

else:

return portfolio_return - sensitivity

def normalizePortfolio(portfolio):

# original portfolio vector: b_origin

# find b = argmin(|b - b_origin|^2) under condition:

# sum(b_i) = 1 and b_i > 0 for all i

# solve the problems using Quadratic Programming Method:

# http://abel.ee.ucla.edu/cvxopt/userguide/coneprog.html#quadratic-programming

n = portfolio.shape[0]

S = cvxopt.matrix(0.0, (n,n))

S[::n+1] = 1.0

S = S.T*S

pbar = cvxopt.matrix(portfolio.values).T*(S + S.T)

pbar = pbar.T

G = cvxopt.matrix(0.0, (n,n))

G[::n+1] = -1.0

h = cvxopt.matrix(0.0, (n,1))

A = cvxopt.matrix(1.0, (1,n))

b = cvxopt.matrix(1.0)

cvxopt.solvers.options['show_progress'] = False

x = cs.qp(S, -pbar, G, h, A, b)['x']

b = portfolio.copy()

for i in range(0, n):

b.ix[b.index[i]] = x[i]

return b

def updatePAMR(portfolio, relative_price, sensitivity, C):

# update portfolio by PAMR2 methods:

# PAMR: Passive Aggressive Mean Reversion Strategy for Portfolio Selection.

# Bin Li, Peilin Zhao, Steven C.H. Hoi, and V. Gopalkrishnan.

# Machine Learning, 2012, 87(2), 221 - 258.

loss = lossFunction(portfolio, relative_price, sensitivity)

avg_ret = relative_price.sum()/relative_price.shape[0]

tmp = ((relative_price - avg_ret)**2).sum() + 1.0/2/C

tau = loss/tmp

return portfolio - tau*(relative_price - avg_ret)