Market Competitiveness

来源:https://uqer.io/community/share/54b5c2f1f9f06c276f651a17

来一个奇葩无厘头的市场竞争策略

策略思路

某一行业的几大龙头股票,在稳定时期此消彼长

策略实现

-

股票池:选择一行业内的流动性比较好的龙头股票;例如三家自助品牌汽车,长安、比亚迪和长城,以下按照三只股票情况讨论

-

观察某一天时,股票价格和该股票在过去几天内平均值的关系

-

如果两只股票下跌,则预测另一只股票上涨;如果两只股票上涨,则预测另一只股票下跌

-

如果某天三只股票中的两只较其平均值有较大幅度下跌,而另一只股票较其平均值比较稳定不变,则买入后面这只比较稳定的股票

-

如果某天三只股票中的两只较其平均值有较大幅度上涨,而另一只股票较其平均值比较稳定不变,则卖出后面这只比较稳定的股票

import quartz

import quartz.backtest as qb

import quartz.performance as qp

from quartz.api import *

import pandas as pd

import numpy as np

from datetime import datetime

from matplotlib import pylab

start = datetime(2012, 1, 1)

end = datetime(2014, 12, 1)

benchmark = 'HS300'

universe = ['000625.XSHE', # 长安汽车

'002594.XSHE', # 比亚迪汽车

'601633.XSHG' # 长城汽车

]

capital_base = 1000000

refresh_rate = 5

window = 10

def initialize(account):

account.amount = 100000

account.universe = universe

add_history('hist', window)

def handle_data(account):

stk_0 = universe[0]

stk_1 = universe[1]

stk_2 = universe[2]

prices_0 = account.hist[stk_0]['closePrice']

prices_1 = account.hist[stk_1]['closePrice']

prices_2 = account.hist[stk_2]['closePrice']

mu_0 = prices_0.mean()

mu_1 = prices_1.mean()

mu_2 = prices_2.mean()

# 两只下跌较大幅度,一只较稳定,买入较稳定这只股票

if prices_0[-1] > mu_0 and prices_1[-1] < 0.975 * mu_1 and prices_2[-1] < 0.975 * mu_2:

order(stk_0, account.amount)

if prices_1[-1] > mu_1 and prices_2[-1] < 0.975 * mu_2 and prices_0[-1] < 0.975 * mu_0:

order(stk_1, account.amount)

if prices_2[-1] > mu_2 and prices_0[-1] < 0.975 * mu_0 and prices_1[-1] < 0.975 * mu_1:

order(stk_2, account.amount)

# 两只上涨较大幅度,一只较稳定,卖出较稳定这只股票

if prices_0[-1] < mu_0 and prices_1[-1] > 1.025 * mu_1 and prices_2[-1] > 1.025 * mu_2:

order_to(stk_0, 0)

if prices_1[-1] < mu_1 and prices_0[-1] > 1.025 * mu_0 and prices_2[-1] > 1.025 * mu_2:

order_to(stk_1, 0)

if prices_2[-1] < mu_2 and prices_0[-1] > 1.025 * mu_0 and prices_1[-1] > 1.025 * mu_1:

order_to(stk_2, 0)

bt

| tradeDate | cash | stock_position | portfolio_value | benchmark_return | blotter | |

|---|---|---|---|---|---|---|

| 0 | 2012-01-18 | 1000000.00000 | {} | 1000000.00000 | 0.000000 | [] |

| 1 | 2012-01-19 | 1000000.00000 | {} | 1000000.00000 | 0.019058 | [] |

| 2 | 2012-01-20 | 1000000.00000 | {} | 1000000.00000 | 0.014478 | [] |

| 3 | 2012-01-30 | 1000000.00000 | {} | 1000000.00000 | -0.017318 | [] |

| 4 | 2012-01-31 | 1000000.00000 | {} | 1000000.00000 | 0.001439 | [] |

| 5 | 2012-02-01 | 1000000.00000 | {} | 1000000.00000 | -0.014311 | [] |

| 6 | 2012-02-02 | 1000000.00000 | {} | 1000000.00000 | 0.023567 | [] |

| 7 | 2012-02-03 | 1000000.00000 | {} | 1000000.00000 | 0.007985 | [] |

| 8 | 2012-02-06 | 1000000.00000 | {} | 1000000.00000 | -0.000705 | [] |

| 9 | 2012-02-07 | 1000000.00000 | {} | 1000000.00000 | -0.018515 | [] |

| 10 | 2012-02-08 | 1000000.00000 | {} | 1000000.00000 | 0.028594 | [] |

| 11 | 2012-02-09 | 1000000.00000 | {} | 1000000.00000 | 0.000394 | [] |

| 12 | 2012-02-10 | 1000000.00000 | {} | 1000000.00000 | 0.001737 | [] |

| 13 | 2012-02-13 | 1000000.00000 | {} | 1000000.00000 | -0.000648 | [] |

| 14 | 2012-02-14 | 1000000.00000 | {} | 1000000.00000 | -0.003900 | [] |

| 15 | 2012-02-15 | 1000000.00000 | {} | 1000000.00000 | 0.010904 | [] |

| 16 | 2012-02-16 | 1000000.00000 | {} | 1000000.00000 | -0.005308 | [] |

| 17 | 2012-02-17 | 1000000.00000 | {} | 1000000.00000 | 0.000399 | [] |

| 18 | 2012-02-20 | 1000000.00000 | {} | 1000000.00000 | 0.001427 | [] |

| 19 | 2012-02-21 | 1000000.00000 | {} | 1000000.00000 | 0.008559 | [] |

| 20 | 2012-02-22 | 1000000.00000 | {} | 1000000.00000 | 0.013668 | [] |

| 21 | 2012-02-23 | 1000000.00000 | {} | 1000000.00000 | 0.003380 | [] |

| 22 | 2012-02-24 | 1000000.00000 | {} | 1000000.00000 | 0.016023 | [] |

| 23 | 2012-02-27 | 1000000.00000 | {} | 1000000.00000 | 0.003231 | [] |

| 24 | 2012-02-28 | 1000000.00000 | {} | 1000000.00000 | 0.002217 | [] |

| 25 | 2012-02-29 | 1000000.00000 | {} | 1000000.00000 | -0.010637 | [] |

| 26 | 2012-03-01 | 1000000.00000 | {} | 1000000.00000 | -0.000303 | [] |

| 27 | 2012-03-02 | 1000000.00000 | {} | 1000000.00000 | 0.017692 | [] |

| 28 | 2012-03-05 | 1000000.00000 | {} | 1000000.00000 | -0.006432 | [] |

| 29 | 2012-03-06 | 1000000.00000 | {} | 1000000.00000 | -0.015641 | [] |

| ... | ... | ... | ... | ... | ... | ... |

| 664 | 2014-10-21 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1913031.23401 | -0.008685 | [] |

| 665 | 2014-10-22 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1933648.47401 | -0.006062 | [] |

| 666 | 2014-10-23 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1953640.67401 | -0.009385 | [] |

| 667 | 2014-10-24 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1823065.79401 | -0.002183 | [] |

| 668 | 2014-10-27 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1859302.04401 | -0.009152 | [] |

| 669 | 2014-10-28 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1863675.44401 | 0.020187 | [] |

| 670 | 2014-10-29 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1871797.24401 | 0.014371 | [] |

| 671 | 2014-10-30 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1883042.97401 | 0.007156 | [] |

| 672 | 2014-10-31 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1913656.09401 | 0.015958 | [] |

| 673 | 2014-11-03 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1902410.64401 | 0.001682 | [] |

| 674 | 2014-11-04 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1964886.42401 | 0.000247 | [] |

| 675 | 2014-11-05 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2049228.79401 | -0.003869 | [] |

| 676 | 2014-11-06 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2020489.70401 | 0.001047 | [] |

| 677 | 2014-11-07 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2027362.02401 | -0.001564 | [] |

| 678 | 2014-11-10 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2043606.06401 | 0.025410 | [] |

| 679 | 2014-11-11 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2022988.64401 | -0.002775 | [] |

| 680 | 2014-11-12 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2049228.91401 | 0.013957 | [] |

| 681 | 2014-11-13 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2054226.61401 | -0.005616 | [] |

| 682 | 2014-11-14 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1987377.18401 | 0.000519 | [] |

| 683 | 2014-11-17 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1988626.85401 | -0.005420 | [] |

| 684 | 2014-11-18 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2006744.97401 | -0.010004 | [] |

| 685 | 2014-11-19 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2014241.95401 | -0.001653 | [] |

| 686 | 2014-11-20 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1980504.81401 | -0.000047 | [] |

| 687 | 2014-11-21 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 1989251.55401 | 0.018273 | [] |

| 688 | 2014-11-24 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2085464.99401 | 0.025470 | [] |

| 689 | 2014-11-25 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2156687.78401 | 0.013702 | [] |

| 690 | 2014-11-26 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2142942.92401 | 0.013949 | [] |

| 691 | 2014-11-27 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2146691.26401 | 0.011557 | [] |

| 692 | 2014-11-28 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2276016.94401 | 0.019724 | [] |

| 693 | 2014-12-01 | 1.56401 | {u'000625.XSHE': 1.0, u'601633.XSHG': 62476.0} | 2245404.03401 | 0.003913 | [] |

694 rows × 6 columns

perf = qp.perf_parse(bt)

out_keys = ['annualized_return', 'volatility', 'information',

'sharpe', 'max_drawdown', 'alpha', 'beta']

for k in out_keys:

print '%s: %s' % (k, perf[k])

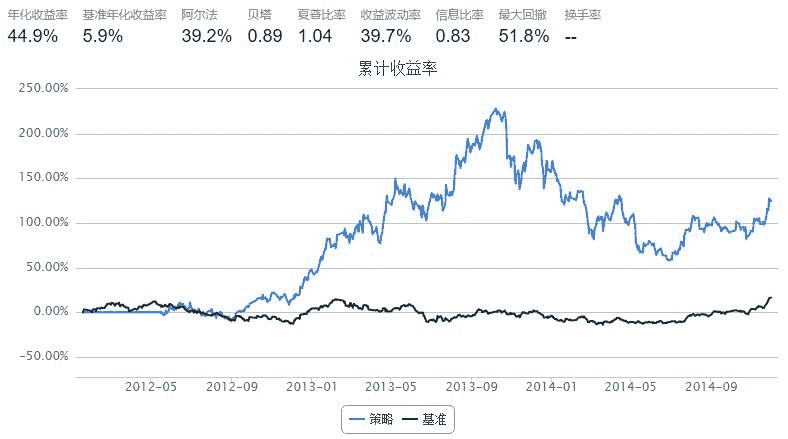

annualized_return: 0.448632577093

volatility: 0.397466535866

information: 0.825863671828

sharpe: 1.04326663926

max_drawdown: 0.518092986656

alpha: 0.392363999248

beta: 0.886220585368

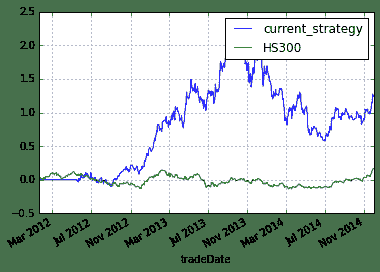

perf['cumulative_return'].plot()

perf['benchmark_cumulative_return'].plot()

pylab.legend(['current_strategy','HS300'])

<matplotlib.legend.Legend at 0x4e27c50>