技术分析入门 【2】 —— 大家抢筹码(06年至12年版)

来源:https://uqer.io/community/share/5541d8a4f9f06c1c3d687fef

在本篇中,我们将使用流通股份的集中程度作为指标,为大家开发如何机智的抢筹码策略!

股市里面总是有这样的一种说法: 大股东总是会快小散一步,悄悄地进村,放枪的不要。大股东会在建仓期吸收世面上的廉价筹码,然后放出利好,逢高出货。所以大股东的建仓期,正是小散们入场分汤的好时机!

1. 数据准备

好了,说了这些原理,到底灵不灵呢?来,一试便知!这里我们首先要定义什么叫大股东呢?这里我们借助中诚信的数据,获取前十大流通股东的持股比例:

数据API:

CCXE.EquMainshFCCXEGet 获取财报中十大流通股股东的持股比例(本API需要在数据商城购买)

下面的语句查询600000.XSHG浦发银行在2014年9月30日到2014年12月31日的十大流通股股东持股情况:

import datetime as dt

data = DataAPI.CCXE.EquMainshFCCXEGet('600000.XSHG', endDateStart='20140930', endDateEnd='20141231')

data.head()

| secID | ticker | exchangeCD | secShortName | secShortNameEn | endDate | shNum | shRank | shName | holdVol | holdPct | shareCharType | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 600000.XSHG | 600000 | XSHG | 浦发银行 | NaN | 2014-12-31 00:00:00 | 1 | 1 | 上海国际集团有限公司 | 3157513917 | 16.93 | 101 |

| 1 | 600000.XSHG | 600000 | XSHG | 浦发银行 | NaN | 2014-12-31 00:00:00 | 2 | 2 | 上海国际信托有限公司 | 975923794 | 5.23 | 101 |

| 2 | 600000.XSHG | 600000 | XSHG | 浦发银行 | NaN | 2014-12-31 00:00:00 | 3 | 3 | 上海国鑫投资发展有限公司 | 377101999 | 2.02 | 101 |

| 3 | 600000.XSHG | 600000 | XSHG | 浦发银行 | NaN | 2014-12-31 00:00:00 | 4 | 4 | 百联集团有限公司 | 190083517 | 1.02 | 101 |

| 4 | 600000.XSHG | 600000 | XSHG | 浦发银行 | NaN | 2014-12-31 00:00:00 | 5 | 5 | 雅戈尔集团股份有限公司 | 162000000 | 0.87 | 101 |

我们按照报表日进行合并,并计算前十大流通股股东持股总比例:

data.groupby('endDate').sum()

| secShortNameEn | shNum | shRank | holdVol | holdPct | shareCharType | |

|---|---|---|---|---|---|---|

| endDate | ||||||

| 2014-09-30 00:00:00 | NaN | 55 | 55 | 5550603395 | 29.76 | 1010 |

| 2014-12-31 00:00:00 | NaN | 55 | 55 | 5455478743 | 29.25 | 1010 |

可以看到,2014年年报中流通股集中度是下降的,相对于上一个季报,持股总比例从29.76%降到了29.25%。看来他的大股东没啥动静,小散们先按兵不动!

2. 策略思路

有一句俗话:不要在一棵树上吊死!小散们可以“海选PK”,择优录取!我们以上证50成分股为例,挑选出满足以下条件的股票:

- 2015年一季度季报中10大流通股股东持股比例相对于去年年报上升10%

这就是我们认定的大股东吸筹码的标志:

from quartz.api import set_universe

import datetime as dt

universe = set_universe('SH50')

for stock in universe:

try:

data = DataAPI.CCXE.EquMainshFCCXEGet(stock, endDateStart='20141231', endDateEnd='20150331')

except:

continue

res = data.groupby('endDate').sum()[-2:]

if len(res.index) == 2 and res.index[1] == '2015-03-31 00:00:00':

chg = res['holdPct'].values[1] / res['holdPct'].values[0] - 1.0

if chg > 0.1:

print '%s: %.4f' % (stock, chg)

601169.XSHG: 0.1236

600887.XSHG: 0.1211

600703.XSHG: 0.1231

选出来有三只股票满足:601169.XSHG, 600887.XSHG, 600703.XSHG

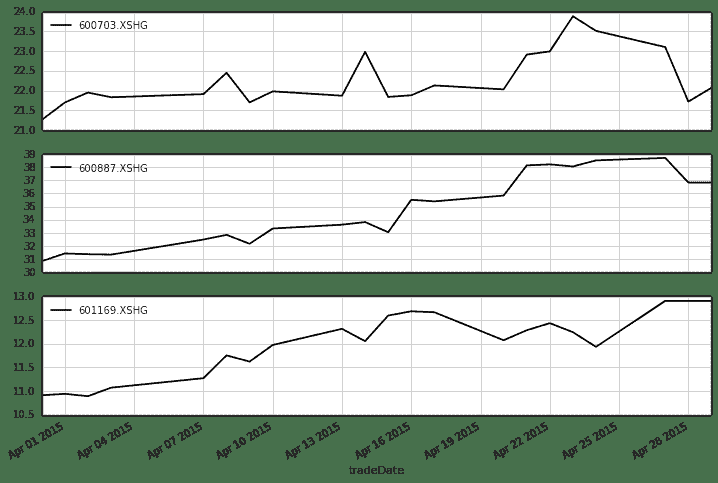

下面的股价走势图来看,这样的股票总体还是上升的。但是按照这样投钱真的靠谱吗?

import pandas as pd

stock1 = DataAPI.MktEqudAdjGet(['601169.XSHG'], beginDate='20150331', endDate='20150429', field = ['closePrice', 'tradeDate'])

stock2 = DataAPI.MktEqudAdjGet(['600887.XSHG'], beginDate='20150331', endDate='20150429', field = ['closePrice', 'tradeDate'])

stock3 = DataAPI.MktEqudAdjGet(['600703.XSHG'], beginDate='20150331', endDate='20150429', field = ['closePrice', 'tradeDate'])

import seaborn as sns

sns.set_style('white')

total = pd.DataFrame({'601169.XSHG':stock1.closePrice.values, '600887.XSHG':stock2.closePrice.values, '600703.XSHG':stock3.closePrice.values})

total.index = stock1.tradeDate.apply(lambda x: dt.datetime.strptime(x, '%Y-%m-%d'))

total.plot(subplots=True, figsize=(12,8))

array([<matplotlib.axes.AxesSubplot object at 0x53fa0d0>,

<matplotlib.axes.AxesSubplot object at 0x57ab9d0>,

<matplotlib.axes.AxesSubplot object at 0x57d0550>], dtype=object)

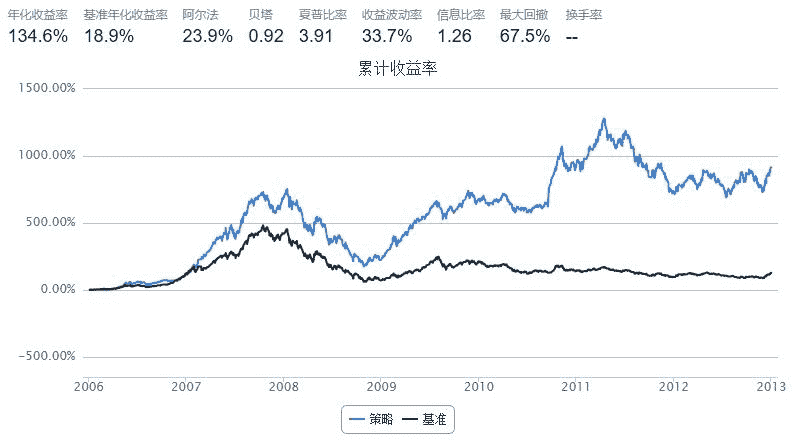

3. 完整策略

我们来吧上面的想法系统化,来看这个策略效率:

- 投资域 :上证50成分股

- 业绩基准 :上证50指数

- 调仓频率 :3个月

- 调仓日期 :每年的2月28日,5月31日,8月30日,11月30日,遇到节假日的话向后顺延

- 开仓信号 :十大流通股股东持股比例集中度上升10%

- 清仓信号 :每个调仓日前一个工作日,清空当前仓位

- 买入方式 :等比例买入

- 回测周期 :2006年1月1日至2015年4月28日

这里的调仓日期的设置,是满足每期报表结束日后的两个月,这样我们有比较大的把握,可以确实拿到当前的报表数据。

import datetime as dt

start = '2006-01-01' # 回测起始时间

end = '2012-12-31' # 回测结束时间

benchmark = 'SH50' # 策略参考标准

universe = set_universe('SH50') # 证券池,支持股票和基金

capital_base = 100000 # 起始资金

longest_history = 1 # handle_data 函数中可以使用的历史数据最长窗口长度

refresh_rate = 1 # 调仓频率,即每 refresh_rate 个交易日执行一次 handle_data() 函数

def initialize(account): # 初始化虚拟账户状态

account.reportingPair = [('0930', '1231'), ('1231', '0331'), ('0331', '0630'), ('0630', '0930')]

def handle_data(account): # 每个交易日的买入卖出指令

hist = account.get_history(longest_history)

today = account.current_date

year = today.year

rebalance_dates = [dt.datetime(year, 2, 28), dt.datetime(year, 5,31), dt.datetime(year, 8, 30), dt.datetime(year, 11,30)]

cal = Calendar('China.SSE')

rebalance_dates = [cal.adjustDate(d, BizDayConvention.Following) for d in rebalance_dates]

rebalanceFlag = False

period = -1

for i, d in enumerate(rebalance_dates):

# 判断是否是调仓日

if today == d.toDateTime():

rebalanceFlag = True

period = i

break

# 调仓日前一个交易日,清空所有的仓位

elif today == cal.advanceDate(d, '-1B').toDateTime():

for stock in account.valid_secpos:

order_to(stock,0)

if rebalanceFlag:

if period == 0:

year -= 1

# 确定当前调仓日对应需要查询的报表日期

if account.reportingPair[period][0] < account.reportingPair[period][1]:

endDateStart = str(year) + account.reportingPair[period][0]

else:

endDateStart = str(year-1) + account.reportingPair[period][0]

endDateEnd = str(year) + account.reportingPair[period][1]

buyList = []

# 确定哪些股票满足“筹码”集中要求

for stock in account.universe:

try:

data = DataAPI.CCXE.EquMainshFCCXEGet(stock, endDateStart=endDateStart, endDateEnd=endDateEnd)

except:

continue

res = data.groupby('endDate').sum()[-2:]

tmp = account.reportingPair[period][1]

if len(res.index) == 2 and res.index[1] == str(year) + '-' + tmp[:2] + '-' + tmp[2:]+ ' 00:00:00':

chg = res['holdPct'].values[1] / res['holdPct'].values[0] - 1.0

if chg > 0.1:

buyList.append(stock)

print u"%s 买入 : %s" % (today, buyList)

# 等权重买入

if len(buyList) != 0:

singleCash = account.cash / len(buyList)

for stock in buyList:

approximationAmount = int(singleCash / hist[stock]['closePrice'][-1]/100.0) * 100

order(stock, approximationAmount)

2006-02-28 00:00:00 买入 : ['600050.XSHG', '600016.XSHG', '600104.XSHG', '600010.XSHG', '600518.XSHG', '600030.XSHG', '600150.XSHG']

2006-05-31 00:00:00 买入 : ['600036.XSHG', '600111.XSHG', '600089.XSHG', '600690.XSHG', '600104.XSHG', '600010.XSHG', '600030.XSHG']

2006-08-30 00:00:00 买入 : ['600050.XSHG', '600196.XSHG', '600000.XSHG', '600703.XSHG', '600089.XSHG', '600104.XSHG', '600637.XSHG', '600837.XSHG', '600150.XSHG']

2006-11-30 00:00:00 买入 : ['600050.XSHG', '600036.XSHG', '600000.XSHG', '600111.XSHG', '600372.XSHG', '600519.XSHG', '600016.XSHG', '600703.XSHG', '600690.XSHG', '600518.XSHG', '600030.XSHG', '600832.XSHG']

2007-02-28 00:00:00 买入 : ['600196.XSHG', '600000.XSHG', '600111.XSHG', '601006.XSHG', '600406.XSHG', '600690.XSHG', '600048.XSHG', '600015.XSHG', '600518.XSHG', '600887.XSHG', '600150.XSHG']

2007-05-31 00:00:00 买入 : ['600111.XSHG', '600256.XSHG', '601166.XSHG', '600104.XSHG', '600015.XSHG', '600637.XSHG', '600837.XSHG']

2007-08-30 00:00:00 买入 : ['600000.XSHG', '600372.XSHG', '600519.XSHG', '600256.XSHG', '600690.XSHG', '600332.XSHG', '601166.XSHG', '600015.XSHG', '600109.XSHG', '600887.XSHG', '601318.XSHG']

2007-11-30 00:00:00 买入 : ['600050.XSHG', '600196.XSHG', '600111.XSHG', '600372.XSHG', '601006.XSHG', '600256.XSHG', '600406.XSHG', '600048.XSHG', '600104.XSHG', '600015.XSHG', '600837.XSHG', '600030.XSHG', '600832.XSHG']

2008-02-28 00:00:00 买入 : ['601328.XSHG', '600050.XSHG', '600196.XSHG', '600000.XSHG', '600018.XSHG', '600016.XSHG', '601006.XSHG', '600406.XSHG', '600104.XSHG', '600028.XSHG', '600518.XSHG', '600837.XSHG', '601169.XSHG', '601398.XSHG']

2008-06-02 00:00:00 买入 : ['600196.XSHG', '601006.XSHG', '600690.XSHG', '601166.XSHG', '600010.XSHG', '600518.XSHG', '601318.XSHG']

2008-09-01 00:00:00 买入 : ['601328.XSHG', '600050.XSHG', '600196.XSHG', '601601.XSHG', '600036.XSHG', '600000.XSHG', '600519.XSHG', '600016.XSHG', '600089.XSHG', '600256.XSHG', '600332.XSHG', '600015.XSHG', '601998.XSHG', '600637.XSHG', '600150.XSHG']

2008-12-01 00:00:00 买入 : ['601601.XSHG', '600372.XSHG', '600703.XSHG', '600690.XSHG', '600104.XSHG', '600837.XSHG', '601169.XSHG', '600030.XSHG', '600832.XSHG']

2009-03-02 00:00:00 买入 : ['601601.XSHG', '600372.XSHG', '600406.XSHG', '600104.XSHG', '600028.XSHG', '600518.XSHG', '600887.XSHG', '600837.XSHG']

2009-06-01 00:00:00 买入 : ['600036.XSHG', '600111.XSHG', '600703.XSHG', '600585.XSHG', '600048.XSHG', '600109.XSHG', '600887.XSHG']

2009-08-31 00:00:00 买入 : ['600050.XSHG', '600196.XSHG', '600000.XSHG', '600111.XSHG', '600519.XSHG', '600703.XSHG', '600089.XSHG', '600256.XSHG', '600332.XSHG', '600015.XSHG', '600010.XSHG', '600887.XSHG', '601766.XSHG', '601398.XSHG', '600150.XSHG']

2009-11-30 00:00:00 买入 : ['600016.XSHG', '601006.XSHG', '600048.XSHG', '600887.XSHG']

2010-03-01 00:00:00 买入 : ['601601.XSHG', '600018.XSHG', '600016.XSHG', '601668.XSHG', '600585.XSHG', '600406.XSHG', '600104.XSHG', '601998.XSHG', '600028.XSHG', '601398.XSHG']

2010-05-31 00:00:00 买入 : ['601299.XSHG', '600111.XSHG', '600256.XSHG', '600999.XSHG', '601628.XSHG', '601318.XSHG']

2010-08-30 00:00:00 买入 : ['601328.XSHG', '600196.XSHG', '601299.XSHG', '600111.XSHG', '600585.XSHG', '601688.XSHG', '601998.XSHG', '600999.XSHG', '600109.XSHG', '601989.XSHG', '600837.XSHG']

2010-11-30 00:00:00 买入 : ['600372.XSHG', '600703.XSHG', '600010.XSHG', '601989.XSHG', '601169.XSHG', '600150.XSHG']

2011-02-28 00:00:00 买入 : ['601601.XSHG', '601857.XSHG', '601299.XSHG', '600372.XSHG', '601288.XSHG', '601668.XSHG', '601088.XSHG', '600256.XSHG', '600999.XSHG', '601989.XSHG', '600837.XSHG']

2011-05-31 00:00:00 买入 : ['601118.XSHG', '601668.XSHG', '601688.XSHG', '600010.XSHG', '600109.XSHG']

2011-08-30 00:00:00 买入 : ['600196.XSHG', '601299.XSHG', '601118.XSHG', '600690.XSHG', '600010.XSHG', '600887.XSHG']

2011-11-30 00:00:00 买入 : ['601299.XSHG', '600372.XSHG', '601118.XSHG', '600703.XSHG', '601288.XSHG', '601818.XSHG', '601766.XSHG']

2012-02-28 00:00:00 买入 : ['600015.XSHG', '600030.XSHG', '601901.XSHG']

2012-05-31 00:00:00 买入 : ['600372.XSHG', '601989.XSHG']

2012-08-30 00:00:00 买入 : ['601118.XSHG', '600837.XSHG', '601901.XSHG']

2012-11-30 00:00:00 买入 : ['601118.XSHG', '601668.XSHG', '601901.XSHG']