【50ETF期权】 4. Greeks 和隐含波动率微笑

来源:https://uqer.io/community/share/560769faf9f06c597165ef75

在本文中,我们将通过量化实验室提供的数据,计算上证50ETF期权的隐含波动率微笑。

from CAL.PyCAL import *

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib import rc

rc('mathtext', default='regular')

import seaborn as sns

sns.set_style('white')

import math

from scipy import interpolate

from scipy.stats import mstats

from pandas import Series, DataFrame, concat

import time

from matplotlib import dates

上海银行间同业拆借利率 SHIBOR,用来作为无风险利率参考

## 银行间质押式回购利率

def getHistDayInterestRateInterbankRepo(date):

cal = Calendar('China.SSE')

period = Period('-10B')

begin = cal.advanceDate(date, period)

begin_str = begin.toISO().replace('-', '')

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的银行间质押式回购利率周期为:

# 1D, 7D, 14D, 21D, 1M, 3M, 4M, 6M, 9M, 1Y

indicID = [u"M120000067", u"M120000068", u"M120000069", u"M120000070", u"M120000071",

u"M120000072", u"M120000073", u"M120000074", u"M120000075", u"M120000076"]

period = np.asarray([1.0, 7.0, 14.0, 21.0, 30.0, 90.0, 120.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interbank_repo = DataAPI.ChinaDataInterestRateInterbankRepoGet(indicID=indicID,beginDate=begin_str,endDate=date_str,field=field,pandas="1")

interbank_repo = interbank_repo.groupby('indicID').first()

interbank_repo = concat([interbank_repo, period_matrix], axis=1, join='inner').sort_index()

return interbank_repo

## 银行间同业拆借利率

def getHistDaySHIBOR(date):

cal = Calendar('China.SSE')

period = Period('-10B')

begin = cal.advanceDate(date, period)

begin_str = begin.toISO().replace('-', '')

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的SHIBOR周期为:

# 1D, 7D, 14D, 1M, 3M, 6M, 9M, 1Y

indicID = [u"M120000057", u"M120000058", u"M120000059", u"M120000060",

u"M120000061", u"M120000062", u"M120000063", u"M120000064"]

period = np.asarray([1.0, 7.0, 14.0, 30.0, 90.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interest_shibor = DataAPI.ChinaDataInterestRateSHIBORGet(indicID=indicID,beginDate=begin_str,endDate=date_str,field=field,pandas="1")

interest_shibor = interest_shibor.groupby('indicID').first()

interest_shibor = concat([interest_shibor, period_matrix], axis=1, join='inner').sort_index()

return interest_shibor

## 插值得到给定的周期的无风险利率

def periodsSplineRiskFreeInterestRate(date, periods):

# 此处使用SHIBOR来插值

init_shibor = getHistDaySHIBOR(date)

shibor = {}

min_period = min(init_shibor.period.values)

min_period = 10.0/360.0

max_period = max(init_shibor.period.values)

for p in periods.keys():

tmp = periods[p]

if periods[p] > max_period:

tmp = max_period * 0.99999

elif periods[p] < min_period:

tmp = min_period * 1.00001

sh = interpolate.spline(init_shibor.period.values, init_shibor.dataValue.values, [tmp], order=3)

shibor[p] = sh[0]/100.0

return shibor

- Greeks 和 隐含波动率计算

本文中计算的Greeks包括:

delta期权价格关于标的价格的一阶导数gamma期权价格关于标的价格的二阶导数rho期权价格关于无风险利率的一阶导数theta期权价格关于到期时间的一阶导数vega期权价格关于波动率的一阶导数

注意:

- 计算隐含波动率,我们采用Black-Scholes-Merton模型,此模型在平台Python包CAL中已有实现

- 无风险利率使用SHIBOR

- 期权的时间价值为负时(此种情况在50ETF期权里时有发生),没法通过BSM模型计算隐含波动率,故此时将期权隐含波动率设为0.0,实际上,此时的隐含波动率和各风险指标并无实际参考价值

## 使用DataAPI.OptGet, DataAPI.MktOptdGet拿到计算所需数据

def getOptDayData(opt_var_sec, date):

date_str = date.toISO().replace('-', '')

#使用DataAPI.OptGet,拿到已退市和上市的所有期权的基本信息

info_fields = [u'optID', u'varSecID', u'varShortName', u'varTicker', u'varExchangeCD', u'varType',

u'contractType', u'strikePrice', u'contMultNum', u'contractStatus', u'listDate',

u'expYear', u'expMonth', u'expDate', u'lastTradeDate', u'exerDate', u'deliDate',

u'delistDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE",u"L"], field=info_fields, pandas="1")

#使用DataAPI.MktOptdGet,拿到历史上某一天的期权成交信息

mkt_fields = [u'ticker', u'optID', u'secShortName', u'exchangeCD', u'tradeDate', u'preSettlePrice',

u'preClosePrice', u'openPrice', u'highestPrice', u'lowestPrice', u'closePrice',

u'settlPrice', u'turnoverVol', u'turnoverValue', u'openInt']

opt_mkt = DataAPI.MktOptdGet(tradeDate=date_str, field=mkt_fields, pandas = "1")

opt_info = opt_info.set_index(u"optID")

opt_mkt = opt_mkt.set_index(u"optID")

opt = concat([opt_info, opt_mkt], axis=1, join='inner').sort_index()

return opt

## 分析历史某一日的期权收盘价信息,得到隐含波动率微笑和期权风险指标

def getOptDayAnalysis(opt_var_sec, date):

opt = getOptDayData(opt_var_sec, date)

#使用DataAPI.MktFunddGet拿到期权标的的日行情

date_str = date.toISO().replace('-', '')

opt_var_mkt = DataAPI.MktFunddGet(secID=opt_var_sec,tradeDate=date_str,beginDate=u"",endDate=u"",field=u"",pandas="1")

#opt_var_mkt = DataAPI.MktFunddAdjGet(secID=opt_var_sec,beginDate=date_str,endDate=date_str,field=u"",pandas="1")

# 计算shibor

exp_dates_str = opt.expDate.unique()

periods = {}

for date_str in exp_dates_str:

exp_date = Date.parseISO(date_str)

periods[exp_date] = (exp_date - date)/360.0

shibor = periodsSplineRiskFreeInterestRate(date, periods)

settle = opt.settlPrice.values # 期权 settle price

close = opt.closePrice.values # 期权 close price

strike = opt.strikePrice.values # 期权 strike price

option_type = opt.contractType.values # 期权类型

exp_date_str = opt.expDate.values # 期权行权日期

eval_date_str = opt.tradeDate.values # 期权交易日期

mat_dates = []

eval_dates = []

spot = []

for epd, evd in zip(exp_date_str, eval_date_str):

mat_dates.append(Date.parseISO(epd))

eval_dates.append(Date.parseISO(evd))

spot.append(opt_var_mkt.closePrice[0])

time_to_maturity = [float(mat - eva + 1.0)/365.0 for (mat, eva) in zip(mat_dates, eval_dates)]

risk_free = [] # 无风险利率

for s, mat, time in zip(spot, mat_dates, time_to_maturity):

#rf = math.log(forward_price[mat] / s) / time

rf = shibor[mat]

risk_free.append(rf)

opt_types = [] # 期权类型

for t in option_type:

if t == 'CO':

opt_types.append(1)

else:

opt_types.append(-1)

# 使用通联CAL包中 BSMImpliedVolatity 计算隐含波动率

calculated_vol = BSMImpliedVolatity(opt_types, strike, spot, risk_free, 0.0, time_to_maturity, settle)

calculated_vol = calculated_vol.fillna(0.0)

# 使用通联CAL包中 BSMPrice 计算期权风险指标

greeks = BSMPrice(opt_types, strike, spot, risk_free, 0.0, calculated_vol.vol.values, time_to_maturity)

greeks.vega = greeks.vega #/ 100.0

greeks.rho = greeks.rho #/ 100.0

greeks.theta = greeks.theta #* 365.0 / 252.0 #/ 365.0

opt['strike'] = strike

opt['optType'] = option_type

opt['expDate'] = exp_date_str

opt['spotPrice'] = spot

opt['riskFree'] = risk_free

opt['timeToMaturity'] = np.around(time_to_maturity, decimals=4)

opt['settle'] = np.around(greeks.price.values.astype(np.double), decimals=4)

opt['iv'] = np.around(calculated_vol.vol.values.astype(np.double), decimals=4)

opt['delta'] = np.around(greeks.delta.values.astype(np.double), decimals=4)

opt['vega'] = np.around(greeks.vega.values.astype(np.double), decimals=4)

opt['gamma'] = np.around(greeks.gamma.values.astype(np.double), decimals=4)

opt['theta'] = np.around(greeks.theta.values.astype(np.double), decimals=4)

opt['rho'] = np.around(greeks.rho.values.astype(np.double), decimals=4)

fields = [u'ticker', u'contractType', u'strikePrice', u'expDate', u'tradeDate',

u'closePrice', u'settlPrice', 'spotPrice', u'iv',

u'delta', u'vega', u'gamma', u'theta', u'rho']

opt = opt[fields].reset_index().set_index('ticker').sort_index()

#opt['iv'] = opt.iv.replace(to_replace=0.0, value=np.nan)

return opt

尝试用 getOptDayAnalysis 计算 2015-09-24 这一天的风险指标

# Uqer 计算期权的风险数据

opt_var_sec = u"510050.XSHG" # 期权标的

date = Date(2015, 9, 24)

option_risk = getOptDayAnalysis(opt_var_sec, date)

option_risk.head(2)

| optID | contractType | strikePrice | expDate | tradeDate | closePrice | settlPrice | spotPrice | iv | delta | vega | gamma | theta | rho | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ticker | ||||||||||||||

| 510050C1510M01850 | 10000405 | CO | 1.85 | 2015-10-28 | 2015-09-24 | 0.3268 | 0.3555 | 2.187 | 0.4317 | 0.9101 | 0.1099 | 0.5550 | -0.2992 | 0.1568 |

| 510050C1510M01900 | 10000406 | CO | 1.90 | 2015-10-28 | 2015-09-24 | 0.2791 | 0.3102 | 2.187 | 0.4161 | 0.8810 | 0.1347 | 0.7058 | -0.3435 | 0.1550 |

进一步,我们和上交所给出的对应日期的风险指标参考数据对比一下

- 上交所的数据需要自行下载,注意选择日期下载相应csv文件,http://www.sse.com.cn/assortment/derivatives/options/risk/

- 下载完后,不做内容改动,请上传到UQER平台的 Data 中;文件名请相应修改,此处我设为了

option_risk_sse_0924.csv - 为了避免冗余,下面我们仅仅对比近月期权的各个风险指标

# 读取上交所数据

def readRiskDataSSE(file_str):

# 按照上交所下载到的risk数据排版格式,做以处理

opt = pd.read_csv(file_str, encoding='gb2312').reset_index()

opt.columns = [['tradeDate','optID','ticker','secShortName','delta','theta','gamma','vega','rho','margin']]

opt = opt[['tradeDate','optID','ticker','delta','theta','gamma','vega','rho']]

opt['ticker'] = [tic[1:-2] for tic in opt['ticker']]

opt['tradeDate'] = [td[0:-1] for td in opt['tradeDate']]

#使用DataAPI.OptGet,拿到已退市和上市的所有期权的基本信息

info_fields = [u'optID', u'varSecID', u'varShortName', u'varTicker', u'varExchangeCD', u'varType',

u'contractType', u'strikePrice', u'contMultNum', u'contractStatus', u'listDate',

u'expYear', u'expMonth', u'expDate', u'lastTradeDate', u'exerDate', u'deliDate',

u'delistDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE",u"L"], field=info_fields, pandas="1")

# 上交所的数据和期权基本信息合并,得到比较完整的期权数据

opt_info = opt_info.set_index(u"optID")

opt = opt.set_index(u"optID")

opt = concat([opt_info, opt], axis=1, join='inner').sort_index()

fields = [u'ticker', u'contractType', u'strikePrice', u'expDate', u'tradeDate',

u'delta', u'vega', u'gamma', u'theta', u'rho']

opt = opt[fields].reset_index().set_index('ticker').sort_index()

return opt

读取 2015-09-24 上交所数据

option_risk_sse = readRiskDataSSE('option_risk_sse_0924.csv')

option_risk_sse.head(2)

| optID | contractType | strikePrice | expDate | tradeDate | delta | vega | gamma | theta | rho | |

|---|---|---|---|---|---|---|---|---|---|---|

| ticker | ||||||||||

| 510050C1510M01850 | 10000405 | CO | 1.85 | 2015-10-28 | 2015-09-24 | 0.910 | 0.109 | 0.555 | -0.303 | 0.154 |

| 510050C1510M01900 | 10000406 | CO | 1.90 | 2015-10-28 | 2015-09-24 | 0.881 | 0.134 | 0.706 | -0.349 | 0.153 |

getOptDayAnalysis 函数计算结果和上交所数据的对比

# 对比本文计算结果 option_risk 和上交所结果 option_risk_sse 中的近月期权风险指标

near_exp = np.sort(option_risk.expDate.unique())[0] # 近月期权行权日

opt_call_uqer = option_risk[option_risk.expDate==near_exp][option_risk.contractType=='CO'].set_index('strikePrice')

opt_call_sse = option_risk_sse[option_risk_sse.expDate==near_exp][option_risk_sse.contractType=='CO'].set_index('strikePrice')

opt_put_uqer = option_risk[option_risk.expDate==near_exp][option_risk.contractType=='PO'].set_index('strikePrice')

opt_put_sse = option_risk_sse[option_risk_sse.expDate==near_exp][option_risk_sse.contractType=='PO'].set_index('strikePrice')

## ----------------------------------------------

## 风险指标对比

fig = plt.figure(figsize=(10,12))

fig.set_tight_layout(True)

# ------ Delta ------

ax = fig.add_subplot(321)

ax.plot(opt_call_uqer.index, opt_call_uqer['delta'], '-')

ax.plot(opt_call_sse.index, opt_call_sse['delta'], 's')

ax.plot(opt_put_uqer.index, opt_put_uqer['delta'], '-')

ax.plot(opt_put_sse.index, opt_put_sse['delta'], 's')

ax.legend(['call-uqer', 'call-sse', 'put-uqer', 'put-sse'])

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Delta")

plt.title('Delta Comparison')

# ------ Theta ------

ax = fig.add_subplot(322)

ax.plot(opt_call_uqer.index, opt_call_uqer['theta'], '-')

ax.plot(opt_call_sse.index, opt_call_sse['theta'], 's')

ax.plot(opt_put_uqer.index, opt_put_uqer['theta'], '-')

ax.plot(opt_put_sse.index, opt_put_sse['theta'], 's')

ax.legend(['call-uqer', 'call-sse', 'put-uqer', 'put-sse'])

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Theta")

plt.title('Theta Comparison')

# ------ Gamma ------

ax = fig.add_subplot(323)

ax.plot(opt_call_uqer.index, opt_call_uqer['gamma'], '-')

ax.plot(opt_call_sse.index, opt_call_sse['gamma'], 's')

ax.plot(opt_put_uqer.index, opt_put_uqer['gamma'], '-')

ax.plot(opt_put_sse.index, opt_put_sse['gamma'], 's')

ax.legend(['call-uqer', 'call-sse', 'put-uqer', 'put-sse'], loc=0)

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Gamma")

plt.title('Gamma Comparison')

# # ------ Vega ------

ax = fig.add_subplot(324)

ax.plot(opt_call_uqer.index, opt_call_uqer['vega'], '-')

ax.plot(opt_call_sse.index, opt_call_sse['vega'], 's')

ax.plot(opt_put_uqer.index, opt_put_uqer['vega'], '-')

ax.plot(opt_put_sse.index, opt_put_sse['vega'], 's')

ax.legend(['call-uqer', 'call-sse', 'put-uqer', 'put-sse'], loc=4)

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Vega")

plt.title('Vega Comparison')

# ------ Rho ------

ax = fig.add_subplot(325)

ax.plot(opt_call_uqer.index, opt_call_uqer['rho'], '-')

ax.plot(opt_call_sse.index, opt_call_sse['rho'], 's')

ax.plot(opt_put_uqer.index, opt_put_uqer['rho'], '-')

ax.plot(opt_put_sse.index, opt_put_sse['rho'], 's')

ax.legend(['call-uqer', 'call-sse', 'put-uqer', 'put-sse'], loc=3)

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Rho")

plt.title('Rho Comparison')

<matplotlib.text.Text at 0x535d0d0>

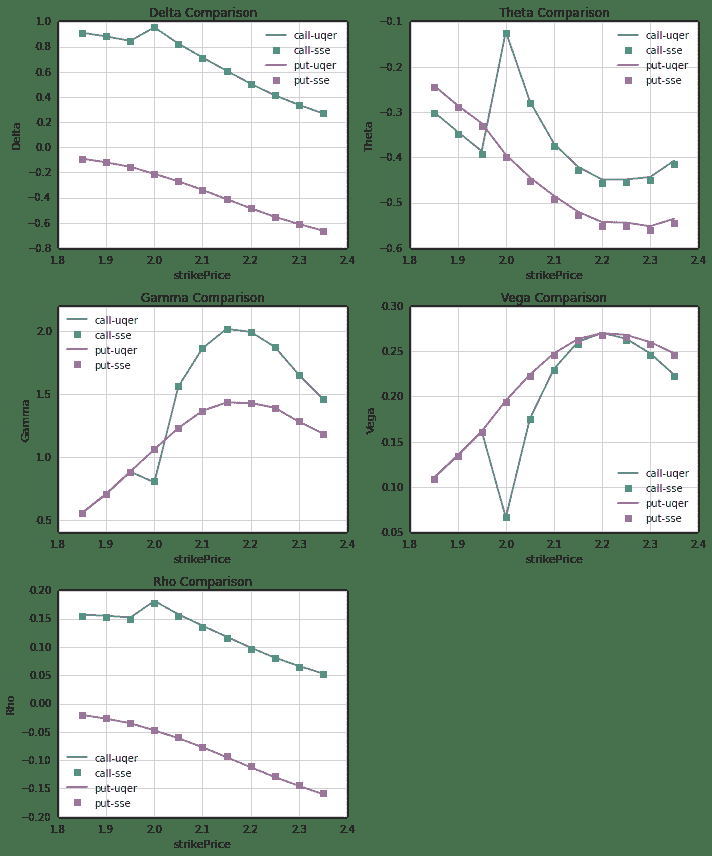

上述五张图中,对于近月期权,我们分别对比了五个Greeks风险指标:Delta, Theta, Gamma, Vega, Rho:

- 每张图中,

Call和Put分开比较,横轴为行权价 - 可以看出,本文中的计算结果和上交所的参考数值符合的比较好

- 在接下来的50ETF期权分析中,我们将使用本文中的计算方法来计算期权隐含波动率和Greeks风险指标

把上面的数据整理整理,格式更简洁一点

# 每日期权分析数据整理

def getOptDayGreeksIV(date):

# Uqer 计算期权的风险数据

opt_var_sec = u"510050.XSHG" # 期权标的

opt = getOptDayAnalysis(opt_var_sec, date)

# 整理数据部分

opt.index = [index[-10:] for index in opt.index]

opt = opt[['contractType','strikePrice','expDate','closePrice','iv','delta','theta','gamma','vega','rho']]

opt_call = opt[opt.contractType=='CO']

opt_put = opt[opt.contractType=='PO']

opt_call.columns = pd.MultiIndex.from_tuples([('Call', c) for c in opt_call.columns])

opt_call[('Call-Put', 'strikePrice')] = opt_call[('Call', 'strikePrice')]

opt_put.columns = pd.MultiIndex.from_tuples([('Put', c) for c in opt_put.columns])

opt = concat([opt_call, opt_put], axis=1, join='inner').sort_index()

opt = opt.set_index(('Call','expDate')).sort_index()

opt = opt.drop([('Call','contractType'), ('Call','strikePrice')], axis=1)

opt = opt.drop([('Put','expDate'), ('Put','contractType'), ('Put','strikePrice')], axis=1)

opt.index.name = 'expDate'

## 以上得到完整的历史某日数据,格式简洁明了

return opt

date = Date(2015, 9, 24)

option_risk = getOptDayGreeksIV(date)

option_risk.head(10)

| Call | Call-Put | Put | |

|---|---|---|---|

| closePrice | iv | delta | theta |

| expDate | |||

| 2015-10-28 | 0.3268 | 0.4317 | 0.9101 |

| 2015-10-28 | 0.2791 | 0.4161 | 0.8810 |

| 2015-10-28 | 0.2360 | 0.3990 | 0.8449 |

| 2015-10-28 | 0.1955 | 0.1811 | 0.9532 |

| 2015-10-28 | 0.1599 | 0.2453 | 0.8237 |

| 2015-10-28 | 0.1275 | 0.2698 | 0.7137 |

| 2015-10-28 | 0.0990 | 0.2814 | 0.6081 |

| 2015-10-28 | 0.0768 | 0.2955 | 0.5057 |

| 2015-10-28 | 0.0584 | 0.3068 | 0.4132 |

| 2015-10-28 | 0.0470 | 0.3264 | 0.3381 |

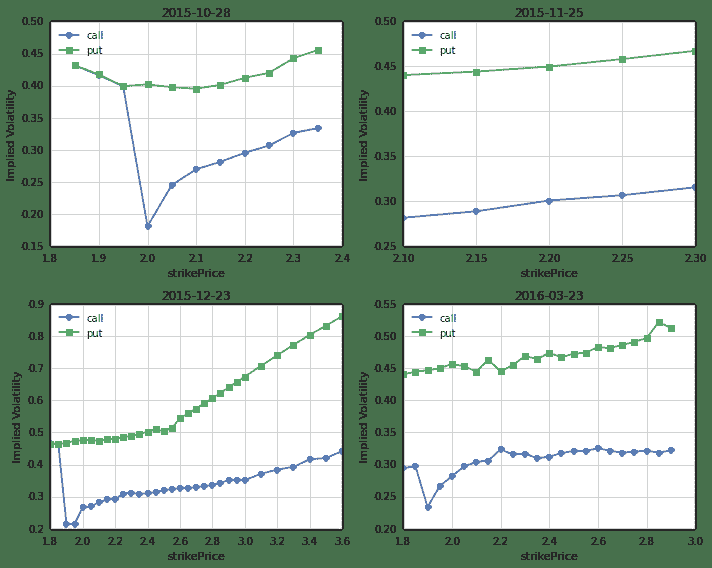

2. 隐含波动率微笑

利用上一小节的代码,给出隐含波动率微笑结构

隐含波动率微笑

# 做图展示某一天的隐含波动率微笑

def plotSmileVolatility(date):

# Uqer 计算期权的风险数据

opt = getOptDayGreeksIV(date)

# 下面展示波动率微笑

exp_dates = np.sort(opt.index.unique())

## ----------------------------------------------

fig = plt.figure(figsize=(10,8))

fig.set_tight_layout(True)

for i in range(exp_dates.shape[0]):

date = exp_dates[i]

ax = fig.add_subplot(2,2,i+1)

opt_date = opt[opt.index==date].set_index(('Call-Put', 'strikePrice'))

opt_date.index.name = 'strikePrice'

ax.plot(opt_date.index, opt_date[('Call', 'iv')], '-o')

ax.plot(opt_date.index, opt_date[('Put', 'iv')], '-s')

ax.legend(['call', 'put'], loc=0)

ax.grid()

ax.set_xlabel(u"strikePrice")

ax.set_ylabel(r"Implied Volatility")

plt.title(exp_dates[i])

plotSmileVolatility(Date(2015,9,24))

行权价和行权日期两个方向上的隐含波动率微笑

from mpl_toolkits.mplot3d import Axes3D

from matplotlib import cm

# 做图展示某一天的隐含波动率结构

def plotSmileVolatilitySurface(date):

# Uqer 计算期权的风险数据

opt = getOptDayGreeksIV(date)

# 下面展示波动率结构

exp_dates = np.sort(opt.index.unique())

strikes = np.sort(opt[('Call-Put', 'strikePrice')].unique())

risk_mt = {'Call': pd.DataFrame(index=strikes),

'Put': pd.DataFrame(index=strikes) }

# 将数据整理成Call和Put分开来,分别的结构为:

# 行为行权价,列为剩余到期天数(以自然天数计算)

for epd in exp_dates:

exp_days = Date.parseISO(epd) - date

opt_date = opt[opt.index==epd].set_index(('Call-Put', 'strikePrice'))

opt_date.index.name = 'strikePrice'

for cp in risk_mt.keys():

risk_mt[cp][exp_days] = opt_date[(cp, 'iv')]

for cp in risk_mt.keys():

for strike in risk_mt[cp].index:

if np.sum(np.isnan(risk_mt[cp].ix[strike])) > 0:

risk_mt[cp] = risk_mt[cp].drop(strike)

# Call和Put分开显示,行index为行权价,列index为剩余到期天数

#print risk_mt

# 画图

for cp in ['Call', 'Put']:

opt = risk_mt[cp]

x = []

y = []

z = []

for xx in opt.index:

for yy in opt.columns:

x.append(xx)

y.append(yy)

z.append(opt[yy][xx])

fig = plt.figure(figsize=(10,8))

fig.suptitle(cp)

ax = fig.gca(projection='3d')

ax.plot_trisurf(x, y, z, cmap=cm.jet, linewidth=0.2)

return risk_mt

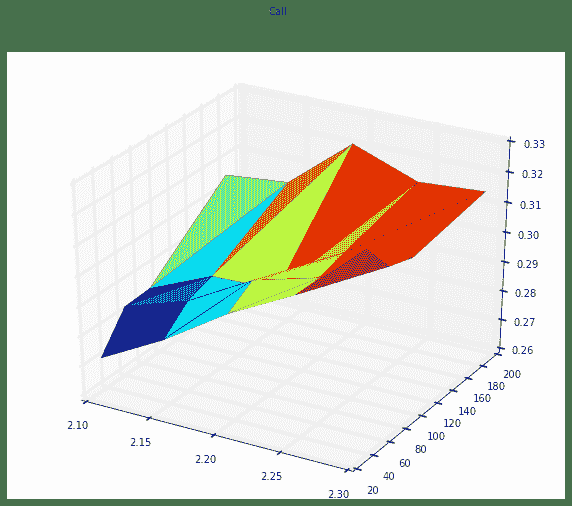

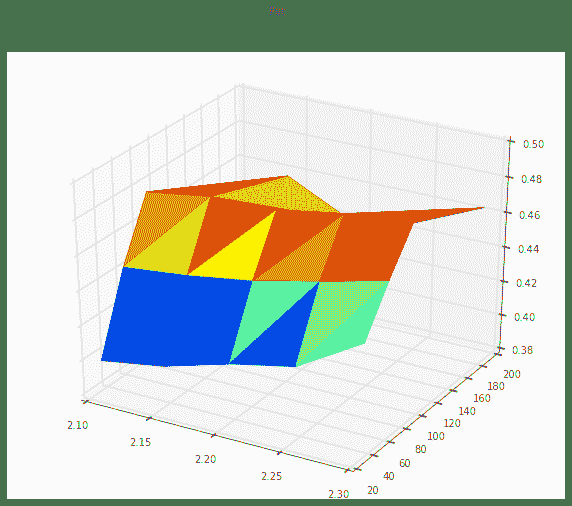

画出某一天的波动率微笑曲面结构

opt = plotSmileVolatilitySurface(Date(2015,9,24))

opt # Call和Put分开显示,行index为行权价,列index为剩余到期天数

{'Call': 34 62 90 181

2.10 0.2698 0.2817 0.2823 0.3042

2.15 0.2814 0.2888 0.2916 0.3063

2.20 0.2955 0.3008 0.2922 0.3237

2.25 0.3068 0.3067 0.3093 0.3157

2.30 0.3264 0.3155 0.3128 0.3172,

'Put': 34 62 90 181

2.10 0.3952 0.4403 0.4740 0.4449

2.15 0.4013 0.4442 0.4794 0.4632

2.20 0.4121 0.4498 0.4802 0.4451

2.25 0.4200 0.4581 0.4863 0.4547

2.30 0.4426 0.4673 0.4893 0.4691}

波动率曲面结构图中:

- 上图为Call,下图为Put,此处没有进行任何插值处理,所以略显粗糙

- Put的隐含波动率明显大于Call

- 期限结构来说,波动率呈现远高近低的特征