【50ETF期权】 3. 中国波指 iVIX

来源:https://uqer.io/community/share/560493f7f9f06c590c65ef21

在本文中,我们将通过量化实验室提供的数据,计算基于50ETF期权的中国波指 iVIX

波动率VIX指数是跟踪市场波动性的指数,一般通过标的期权的隐含波动率计算得来。当VIX越高,表示市场参与者预期后市波动程度会更加激烈,同时也反映其不安的心理状态;相反,VIX越低时,则反映市场参与者预期后市波动程度会趋于缓和。因此,VIX又被称为投资人恐慌指标(The Investor Fear Gauge)。

中国波指由上交所发布,用于衡量上证50ETF未来30日的预期波动。按照上交所网页描述:该指数是根据方差互换的原理,结合50ETF期权的实际运作特点,并通过对上证所交易的50ETF期权价格的计算编制而得。网址为: http://www.sse.com.cn/assortment/derivatives/options/volatility/ , 该网页中发布历史 iVIX 和当日日内 iVIX 数据

from CAL.PyCAL import *

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import rc

rc('mathtext', default='regular')

import seaborn as sns

sns.set_style('white')

from matplotlib import dates

from pandas import Series, DataFrame, concat

from scipy import interpolate

import math

import time

上证50ETF收盘价,用来和iVIX对比走势

# 华夏上证50ETF

secID = '510050.XSHG'

begin = Date(2015, 2, 9)

end = Date.todaysDate()

fields = ['tradeDate', 'closePrice']

etf = DataAPI.MktFunddGet(secID, beginDate=begin.toISO().replace('-', ''), endDate=end.toISO().replace('-', ''), field=fields)

etf['tradeDate'] = pd.to_datetime(etf['tradeDate'])

etf = etf.set_index('tradeDate')

etf.tail(2)

| closePrice | |

|---|---|

| tradeDate | |

| 2015-09-23 | 2.180 |

| 2015-09-24 | 2.187 |

上海银行间同业拆借利率 SHIBOR,用来作为无风险利率参考

## 银行间质押式回购利率

def getHistDayInterestRateInterbankRepo(date):

cal = Calendar('China.SSE')

period = Period('-10B')

begin = cal.advanceDate(date, period)

begin_str = begin.toISO().replace('-', '')

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的银行间质押式回购利率周期为:

# 1D, 7D, 14D, 21D, 1M, 3M, 4M, 6M, 9M, 1Y

indicID = [u"M120000067", u"M120000068", u"M120000069", u"M120000070", u"M120000071",

u"M120000072", u"M120000073", u"M120000074", u"M120000075", u"M120000076"]

period = np.asarray([1.0, 7.0, 14.0, 21.0, 30.0, 90.0, 120.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interbank_repo = DataAPI.ChinaDataInterestRateInterbankRepoGet(indicID=indicID,beginDate=begin_str,endDate=date_str,field=field,pandas="1")

interbank_repo = interbank_repo.groupby('indicID').first()

interbank_repo = concat([interbank_repo, period_matrix], axis=1, join='inner').sort_index()

return interbank_repo

## 银行间同业拆借利率

def getHistDaySHIBOR(date):

date_str = date.toISO().replace('-', '')

# 以下的indicID分别对应的SHIBOR周期为:

# 1D, 7D, 14D, 1M, 3M, 6M, 9M, 1Y

indicID = [u"M120000057", u"M120000058", u"M120000059", u"M120000060",

u"M120000061", u"M120000062", u"M120000063", u"M120000064"]

period = np.asarray([1.0, 7.0, 14.0, 30.0, 90.0, 180.0, 270.0, 360.0]) / 360.0

period_matrix = pd.DataFrame(index=indicID, data=period, columns=['period'])

field = u"indicID,indicName,publishTime,periodDate,dataValue,unit"

interest_shibor = DataAPI.ChinaDataInterestRateSHIBORGet(indicID=indicID,beginDate=date_str,endDate=date_str,field=field,pandas="1")

interest_shibor = interest_shibor.set_index('indicID')

interest_shibor = concat([interest_shibor, period_matrix], axis=1, join='inner').sort_index()

return interest_shibor

## 插值得到给定的周期的无风险利率

def periodsSplineRiskFreeInterestRate(date, periods):

# 此处使用SHIBOR来插值

init_shibor = getHistDaySHIBOR(date)

shibor = {}

min_period = min(init_shibor.period.values)

max_period = max(init_shibor.period.values)

for p in periods.keys():

tmp = periods[p]

if periods[p] > max_period:

tmp = max_period * 0.99999

elif periods[p] < min_period:

tmp = min_period * 1.00001

sh = interpolate.spline(init_shibor.period.values, init_shibor.dataValue.values, [tmp], order=3)

shibor[p] = sh[0]/100.0

return shibor

50ETF历史波动率,用来和iVIX走势作对比

## 计算一段时间标的的历史波动率,返回值包括以下不同周期的波动率:

# 一周,半月,一个月,两个月,三个月,四个月,五个月,半年,九个月,一年,两年

def getHistVolatilityEWMA(secID, beginDate, endDate):

cal = Calendar('China.SSE')

spotBeginDate = cal.advanceDate(beginDate,'-520B',BizDayConvention.Preceding)

spotBeginDate = Date(2006, 1, 1)

begin = spotBeginDate.toISO().replace('-', '')

end = endDate.toISO().replace('-', '')

fields = ['tradeDate', 'preClosePrice', 'closePrice', 'settlePrice', 'preSettlePrice']

security = DataAPI.MktFunddGet(secID, beginDate=begin, endDate=end, field=fields)

security['dailyReturn'] = security['closePrice']/security['preClosePrice'] # 日回报率

security['u2'] = (np.log(security['dailyReturn']))**2 # u2为复利形式的日回报率平方

# security['u2'] = (security['dailyReturn'] - 1.0)**2 # u2为日价格变化百分比的平方

security['tradeDate'] = pd.to_datetime(security['tradeDate'])

periods = {'hv1W': 5, 'hv2W': 10, 'hv1M': 21, 'hv2M': 41, 'hv3M': 62, 'hv4M': 83,

'hv5M': 104, 'hv6M': 124, 'hv9M': 186, 'hv1Y': 249, 'hv2Y': 497}

# 利用pandas中的ewma模型计算波动率

for prd in periods.keys():

# 此处的span实际上就是上面计算波动率公式中lambda表达式中的N

security[prd] = np.round(np.sqrt(pd.ewma(security['u2'], span=periods[prd], adjust=False)), 5)*math.sqrt(252.0)

security = security[security.tradeDate >= beginDate.toISO()]

security = security.set_index('tradeDate')

return security

1. 计算历史每日 iVIX

计算方法参考CBOE的手册:http://www.cboe.com/micro/vix/part2.aspx

# 计算历史某一天的iVIX

def calDayVIX(date, opt_info):

var_sec = u"510050.XSHG"

# 使用DataAPI.MktOptdGet,拿到历史上某一天的期权行情信息

date_str = date.toISO().replace('-', '')

fields_mkt = [u"optID", "tradeDate", "closePrice", 'settlPrice']

opt_mkt = DataAPI.MktOptdGet(tradeDate=date_str, field=fields_mkt, pandas="1")

opt_mkt = opt_mkt.set_index(u"optID")

opt_mkt[u"price"] = opt_mkt['closePrice']

# concat某一日行情和期权基本信息,得到所需数据

opt = concat([opt_info, opt_mkt], axis=1, join='inner').sort_index()

opt = opt[opt.varSecID==var_sec]

exp_dates = map(Date.parseISO, np.sort(opt.expDate.unique()))

trade_date = date

exp_periods = {}

for epd in exp_dates:

exp_periods[epd] = (epd - date)*1.0/365.0

risk_free = periodsSplineRiskFreeInterestRate(trade_date, exp_periods)

sigma_square = {}

for date in exp_dates:

# 计算某一日的vix

opt_date = opt[opt.expDate==date.toISO()]

rf = risk_free[date]

#rf = 0.05

opt_call = opt_date[opt_date.contractType == 'CO'].set_index('strikePrice')

opt_put = opt_date[opt_date.contractType == 'PO'].set_index('strikePrice')

opt_call_price = opt_call[[u'price']].sort_index()

opt_put_price = opt_put[[u'price']].sort_index()

opt_call_price.columns = [u'callPrice']

opt_put_price.columns = [u'putPrice']

opt_call_put_price = concat([opt_call_price, opt_put_price], axis=1, join='inner').sort_index()

opt_call_put_price['diffCallPut'] = opt_call_put_price.callPrice - opt_call_put_price.putPrice

strike = abs(opt_call_put_price['diffCallPut']).idxmin()

price_diff = opt_call_put_price['diffCallPut'][strike]

ttm = exp_periods[date]

fw = strike + np.exp(ttm*rf) * price_diff

strikes = np.sort(opt_call_put_price.index.values)

delta_K_tmp = np.concatenate((strikes, strikes[-1:], strikes[-1:]))

delta_K_tmp = delta_K_tmp - np.concatenate((strikes[0:1], strikes[0:1], strikes))

delta_K = np.concatenate((delta_K_tmp[1:2], delta_K_tmp[2:-2]/2, delta_K_tmp[-2:-1]))

delta_K = pd.DataFrame(delta_K, index=strikes, columns=['deltaStrike'])

# opt_otm = opt_out_of_money

opt_otm = concat([opt_call[opt_call.index>fw], opt_put[opt_put.index<fw]], axis=0, join='inner')

opt_otm = concat([opt_otm, delta_K], axis=1, join='inner').sort_index()

# 计算VIX时,比forward price低的第一个行权价被设置为参考行权价,参考值以上

# 的call和以下的put均为虚值期权,所有的虚值期权被用来计算VIX,然而计算中发

# 现,有时候没有比forward price更低的行权价,例如2015-07-08,故有以下关于

# 参考行权价的设置

strike_ref = fw

if len((strikes[strikes < fw])) > 0:

strike_ref = max([k for k in strikes[strikes < fw]])

opt_otm['price'][strike_ref] = (opt_call['price'][strike_ref] + opt_call['price'][strike_ref])/2.0

exp_rt = np.exp(rf*ttm)

opt_otm['sigmaTerm'] = opt_otm.deltaStrike*opt_otm.price/(opt_otm.index)**2

sigma = opt_otm.sigmaTerm.sum()

sigma = (sigma*2.0*exp_rt - (fw*1.0/strike_ref - 1.0)**2)/ttm

sigma_square[date] = sigma

# d_one, d_two 将被用来计算VIX(30):

if exp_periods[exp_dates[0]] >= 1.0/365.0:

d_one = exp_dates[0]

d_two = exp_dates[1]

else:

d_one = exp_dates[1]

d_two = exp_dates[2]

w = (exp_periods[d_two] - 30.0/365.0)/(exp_periods[d_two] - exp_periods[d_one])

vix30 = exp_periods[d_one]*w*sigma_square[d_one] + exp_periods[d_two]*(1 - w)*sigma_square[d_two]

vix30 = 100*np.sqrt(vix30*365.0/30.0)

# d_one, d_two 将被用来计算VIX(60):

d_one = exp_dates[1]

d_two = exp_dates[2]

w = (exp_periods[d_two] - 60.0/365.0)/(exp_periods[d_two] - exp_periods[d_one])

vix60 = exp_periods[d_one]*w*sigma_square[d_one] + exp_periods[d_two]*(1 - w)*sigma_square[d_two]

vix60 = 100*np.sqrt(vix60*365.0/60.0)

return vix30, vix60

def getHistDailyVIX(beginDate, endDate):

# 计算历史一段时间内的VIX指数并返回

optionVarSecID = u"510050.XSHG"

# 使用DataAPI.OptGet,一次拿取所有存在过的期权信息,以备后用

fields_info = ["optID", u"varSecID", u'contractType', u'strikePrice', u'expDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE", u"L"], field=fields_info, pandas="1")

opt_info = opt_info.set_index(u"optID")

cal = Calendar('China.SSE')

cal.addHoliday(Date(2015,9,3))

cal.addHoliday(Date(2015,9,4))

dates = cal.bizDatesList(beginDate, endDate)

histVIX = pd.DataFrame(0.0, index=map(Date.toDateTime, dates), columns=['VIX30','VIX60'])

histVIX.index.name = 'tradeDate'

for date in histVIX.index:

try:

vix30, vix60 = calDayVIX(Date.fromDateTime(date), opt_info)

except:

histVIX = histVIX.drop(date)

continue

histVIX['VIX30'][date] = vix30

histVIX['VIX60'][date] = vix60

return histVIX

def getHistOneDayVIX(date):

# 计算历史某天的VIX指数并返回

optionVarSecID = u"510050.XSHG"

# 使用DataAPI.OptGet,一次拿取所有存在过的期权信息,以备后用

fields_info = ["optID", u"varSecID", u'contractType', u'strikePrice', u'expDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE", u"L"], field=fields_info, pandas="1")

opt_info = opt_info.set_index(u"optID")

cal = Calendar('China.SSE')

cal.addHoliday(Date(2015,9,3))

cal.addHoliday(Date(2015,9,4))

if cal.isBizDay(date):

vix30, vix60 = 0.0, 0.0

vix30, vix60 = calDayVIX(date, opt_info)

return vix30, vix60

else:

print date, "不是工作日"

历史每日iVIX 数据

begin = Date(2015, 2, 9) # 起始日

end = Date.todaysDate() # 截至今天

hist_VIX = getHistDailyVIX(begin, end)

hist_VIX.tail()

| VIX30 | VIX60 | |

|---|---|---|

| tradeDate | ||

| 2015-09-18 | 38.057648 | 39.074643 |

| 2015-09-21 | 37.610259 | 38.559095 |

| 2015-09-22 | 34.507456 | 36.788384 |

| 2015-09-23 | 36.413426 | 37.837454 |

| 2015-09-24 | 37.114348 | 24.346747 |

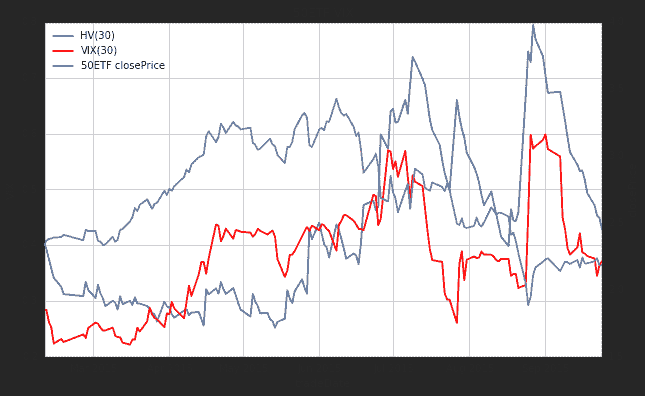

iVIX、50ETF收盘价、50ETF波动率比较

start = Date(2007, 1, 1)

end = Date.todaysDate()

secID = '510050.XSHG'

hist_HV = getHistVolatilityEWMA(secID, start, end)

## ----- 50ETF VIX指数和历史波动率比较 -----

fig = plt.figure(figsize=(10,6))

ax = fig.add_subplot(111)

font.set_size(16)

hist_HV_plot = hist_HV[hist_HV.index >= Date(2015,2,9).toISO()]

etf_plot = etf[etf.index >= Date(2015,2,9).toISO()]

lns1 = ax.plot(hist_HV_plot.index, hist_HV_plot.hv1M, '-', label = u'HV(30)')

lns2 = ax.plot(hist_VIX.index, hist_VIX.VIX30/100.0, '-r', label = u'VIX(30)')

#lns3 = ax.plot(hist_VIX.index, hist_VIX.VIX60/100.0, '-g', label = u'VIX(60)')

ax2 = ax.twinx()

lns4 = ax2.plot(etf_plot.index, etf_plot.closePrice, 'grey', label = '50ETF closePrice')

lns = lns1+lns2+lns4

labs = [l.get_label() for l in lns]

ax.legend(lns, labs, loc=2)

ax.grid()

ax.set_xlabel(u"tradeDate")

ax.set_ylabel(r"VIX")

ax2.set_ylabel(r"closePrice")

#ax.set_ylim(0, 0.80)

ax2.set_ylim(1.5, 4)

plt.title('50ETF VIX')

<matplotlib.text.Text at 0x5acec90>

2. 基于iVIX的择时策略

策略思路:

- 计算 VIX 三日均线

- 前一日 VIX 向上穿过三日均线一定比例,则卖出

- 前一日 VIX 向下穿过三日均线一定比例,则买入

- 只买卖50ETF

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 9, 24) # 回测结束时间

hist_VIX = getHistDailyVIX(start, end)

hist_VIX.tail(2)

| VIX30 | VIX60 | |

|---|---|---|

| tradeDate | ||

| 2015-09-23 | 36.413426 | 37.837454 |

| 2015-09-24 | 37.114348 | 24.346747 |

start = datetime(2015, 2, 9) # 回测起始时间

end = datetime(2015, 9, 24) # 回测结束时间

benchmark = '510050.XSHG' # 策略参考标准

universe = ['510050.XSHG'] # 股票池

capital_base = 100000 # 起始资金

commission = Commission(0.0,0.0)

window_short = 1

window_long = 3

SD = 0.1

hist_VIX['short_window'] = pd.rolling_mean(hist_VIX['VIX30'], window=window_short)

hist_VIX['long_window'] = pd.rolling_mean(hist_VIX['VIX30'], window=window_long)

def initialize(account): # 初始化虚拟账户状态

account.fund = universe[0]

def handle_data(account): # 每个交易日的买入卖出指令

fund = account.fund

# 获取回测当日的前一天日期

dt = Date.fromDateTime(account.current_date)

cal = Calendar('China.IB')

cal.addHoliday(Date(2015,9,3))

cal.addHoliday(Date(2015,9,4))

last_day = cal.advanceDate(dt,'-1B',BizDayConvention.Preceding) #计算出倒数第一个交易日

last_last_day = cal.advanceDate(last_day,'-1B',BizDayConvention.Preceding) #计算出倒数第二个交易日

last_day_str = last_day.strftime("%Y-%m-%d")

last_last_day_str = last_last_day.strftime("%Y-%m-%d")

# 计算买入卖出信号

try:

short_mean = hist_VIX['short_window'].loc[last_day_str] # 短均线值

long_mean = hist_VIX['long_window'].loc[last_day_str] # 长均线值

long_flag = True if (short_mean - long_mean) < - SD * long_mean else False

short_flag = True if (short_mean - long_mean) > SD * long_mean else False

except:

long_flag = True

short_flag = True

if long_flag:

approximationAmount = int(account.cash / account.referencePrice[fund] / 100.0) * 100

order(fund, approximationAmount)

elif short_flag:

# 卖出时,全仓清空

order_to(fund, 0)

3. 日内跟踪计算 iVIX

计算方法和日间iVIX类似

def calSnapshotVIX(date, opt_info):

var_sec = u"510050.XSHG"

# 使用DataAPI.MktOptdGet,拿到历史上某一天的期权行情信息

date_str = date.toISO().replace('-', '')

fields_mkt = [u'optionId', u'dataDate', u'highPrice', u'lastPrice', u'lowPrice', u'openPrice', u'preSettlePrice', u'bidBook_price1', u'bidBook_volume1', u'askBook_price1', u'askBook_volume1']

# opt_mkt = DataAPI.MktOptdGet(tradeDate=date_str, field=fields_mkt, pandas="1")

opt_mkt = DataAPI.MktOptionTickRTSnapshotGet(optionId=u"", field='', pandas="1")

opt_mkt = opt_mkt[opt_mkt.dataDate == date.toISO()]

opt_mkt['optID'] = map(int, opt_mkt['optionId'])

opt_mkt = opt_mkt.set_index(u"optID")

opt_mkt[u"price"] = (opt_mkt['bidBook_price1'] + opt_mkt['askBook_price1'])/2.0

# concat某一日行情和期权基本信息,得到所需数据

opt = concat([opt_info, opt_mkt], axis=1, join='inner').sort_index()

#opt = opt[opt.varSecID==var_sec]

exp_dates = map(Date.parseISO, np.sort(opt.expDate.unique()))

trade_date = date

exp_periods = {}

for epd in exp_dates:

exp_periods[epd] = (epd - date)*1.0/365.0

risk_free = periodsSplineRiskFreeInterestRate(trade_date, exp_periods)

sigma_square = {}

for date in exp_dates:

# 计算某一日的vix

opt_date = opt[opt.expDate==date.toISO()]

rf = risk_free[date]

#rf = 0.05

opt_call = opt_date[opt_date.contractType == 'CO'].set_index('strikePrice')

opt_put = opt_date[opt_date.contractType == 'PO'].set_index('strikePrice')

opt_call_price = opt_call[[u'price']].sort_index()

opt_put_price = opt_put[[u'price']].sort_index()

opt_call_price.columns = [u'callPrice']

opt_put_price.columns = [u'putPrice']

opt_call_put_price = concat([opt_call_price, opt_put_price], axis=1, join='inner').sort_index()

opt_call_put_price['diffCallPut'] = opt_call_put_price.callPrice - opt_call_put_price.putPrice

strike = abs(opt_call_put_price['diffCallPut']).idxmin()

price_diff = opt_call_put_price['diffCallPut'][strike]

ttm = exp_periods[date]

fw = strike + np.exp(ttm*rf) * price_diff

strikes = np.sort(opt_call_put_price.index.values)

delta_K_tmp = np.concatenate((strikes, strikes[-1:], strikes[-1:]))

delta_K_tmp = delta_K_tmp - np.concatenate((strikes[0:1], strikes[0:1], strikes))

delta_K = np.concatenate((delta_K_tmp[1:2], delta_K_tmp[2:-2]/2, delta_K_tmp[-2:-1]))

delta_K = pd.DataFrame(delta_K, index=strikes, columns=['deltaStrike'])

# opt_otm = opt_out_of_money

opt_otm = concat([opt_call[opt_call.index>fw], opt_put[opt_put.index<fw]], axis=0, join='inner')

opt_otm = concat([opt_otm, delta_K], axis=1, join='inner').sort_index()

# 计算VIX时,比forward price低的第一个行权价被设置为参考行权价,参考值以上

# 的call和以下的put均为虚值期权,所有的虚值期权被用来计算VIX,然而计算中发

# 现,有时候没有比forward price更低的行权价,例如2015-07-08,故有以下关于

# 参考行权价的设置

strike_ref = fw

if len((strikes[strikes < fw])) > 0:

strike_ref = max([k for k in strikes[strikes < fw]])

opt_otm['price'][strike_ref] = (opt_call['price'][strike_ref] + opt_call['price'][strike_ref])/2.0

exp_rt = np.exp(rf*ttm)

opt_otm['sigmaTerm'] = opt_otm.deltaStrike*opt_otm.price/(opt_otm.index)**2

sigma = opt_otm.sigmaTerm.sum()

sigma = (sigma*2.0*exp_rt - (fw*1.0/strike_ref - 1.0)**2)/ttm

sigma_square[date] = sigma

# d_one, d_two 将被用来计算VIX(30):

if exp_periods[exp_dates[0]] >= 1.0/365.0:

d_one = exp_dates[0]

d_two = exp_dates[1]

else:

d_one = exp_dates[1]

d_two = exp_dates[2]

w = (exp_periods[d_two] - 30.0/365.0)/(exp_periods[d_two] - exp_periods[d_one])

vix30 = exp_periods[d_one]*w*sigma_square[d_one] + exp_periods[d_two]*(1 - w)*sigma_square[d_two]

vix30 = 100*np.sqrt(vix30*365.0/30.0)

# d_one, d_two 将被用来计算VIX(60):

d_one = exp_dates[1]

d_two = exp_dates[2]

w = (exp_periods[d_two] - 60.0/365.0)/(exp_periods[d_two] - exp_periods[d_one])

vix60 = exp_periods[d_one]*w*sigma_square[d_one] + exp_periods[d_two]*(1 - w)*sigma_square[d_two]

vix60 = 100*np.sqrt(vix60*365.0/60.0)

return vix30, vix60

def getTodaySnapshotVIX():

# 计算历史某天的VIX指数并返回

optionVarSecID = u"510050.XSHG"

date = Date.todaysDate()

# 使用DataAPI.OptGet,一次拿取所有存在过的期权信息,以备后用

fields_info = ["optID", u"varSecID", u'contractType', u'strikePrice', u'expDate']

opt_info = DataAPI.OptGet(optID='', contractStatus=[u"DE", u"L"], field=fields_info, pandas="1")

opt_info = opt_info.set_index(u"optID")

cal = Calendar('China.SSE')

cal.addHoliday(Date(2015,9,3))

cal.addHoliday(Date(2015,9,4))

if cal.isBizDay(date):

now_long = datetime.now()

now = now_long.time().isoformat()

if (now > '09:25:00' and now < '11:30:00') or (now > '13:00:00' and now < '15:00:00'):

vix30, vix60 = calSnapshotVIX(date, opt_info)

vix = pd.DataFrame([[date, vix30, vix60]], index=[now_long], columns=['dataDate', 'VIX30', 'VIX60'])

vix.index.name = 'time'

else:

vix = pd.DataFrame(0.0, index=[], columns=['dataDate', 'VIX30', 'VIX60'])

vix.index.name = 'time'

return vix

else:

print "今天: ", date, " 不是工作日"

计算即时的VIX

如果在工作日非交易时间运行计算函数,则得到一个空的dataframe

getTodaySnapshotVIX()

| dataDate | VIX30 | VIX60 | |

|---|---|---|---|

| time |

跟踪计算当日日内 VIX 走势

## 此函数跟踪计算并记录当日日内VIX走势,数据记录在:

# 文件 'VIX_intraday_' + Date.todaysDate().toISO() + '.csv' 中

# 该文件保存在登录uqer账号的 Data 空间中

# seconds 为跟踪计算间隔秒数

def trackTodayIntradayVIX(seconds):

vix_file_str = 'VIX_intraday_' + Date.todaysDate().toISO() + '.csv'

vix = pd.DataFrame(0.0, index=[], columns=['dataDate', 'VIX30', 'VIX60'])

vix.index.name = 'time'

vix.to_csv(vix_file_str)

now = datetime.now().time()

while now.isoformat() < '15:00:00':

vix = pd.read_csv(vix_file_str).set_index('time')

vix_now = getTodaySnapshotVIX()

if vix_now.shape[0] > 0:

vix = vix.append(vix_now)

vix.to_csv(vix_file_str)

# print vix_now.index[0], '\t', vix_now.VIX30[0], '\t', vix_now.VIX60[0]

time.sleep(seconds)

now = datetime.now().time()

注意:

trackTodayIntradayVIX 函数一经运行,便持续到当日收盘时,除非手动终止运行

# 追踪当前iVIX走势,每隔60秒计算一次即时iVIX

time_interval = 60

trackTodayIntradayVIX(time_interval)

---------------------------------------------------------------------------

KeyboardInterrupt Traceback (most recent call last)

<mercury-input-20-3f8b5a5070f8> in <module>()

1 # 追踪当前iVIX走势,每隔60秒计算一次即时iVIX

2 time_interval = 60

----> 3 trackTodayIntradayVIX(time_interval)

<mercury-input-19-d53f12cb0e4a> in trackTodayIntradayVIX(seconds)

17 vix.to_csv(vix_file_str)

18 # print vix_now.index[0], '\t', vix_now.VIX30[0], '\t', vix_now.VIX60[0]

---> 19 time.sleep(seconds)

20 now = datetime.now().time()

KeyboardInterrupt:

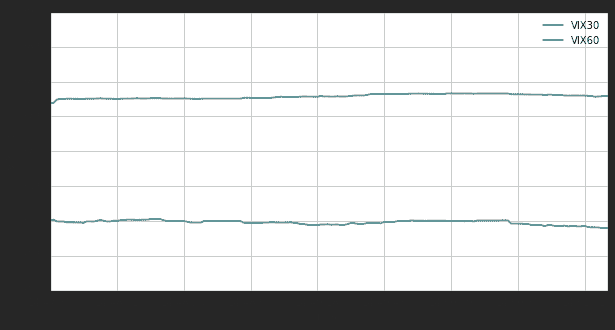

将当日追踪到的iVIX日内走势作图,注意读取数据文件名和 trackTodayIntradayVIX 函数中的存储文件名一致

vix_file_str = 'VIX_intraday_2015-09-23-backup.csv'

vix = pd.read_csv(vix_file_str)

vix['time'] = [x[11:19] for x in vix.time]

vix = vix.set_index('time')

ax = vix.plot(figsize=(10,5))

ax.set_xlabel('time')

ax.set_ylabel('VIX(%)')

ax.set_ylim(35, 39)

(35, 39)