Zscore Model Tutorial

来源:https://uqer.io/community/share/54ab4407f9f06c276f6519ec

1. 什么是 Zscore Model

信用风险评分方法通常包括定性法、单变量法、多变量法,目前广泛采用多变量方法包括如判别分析(discriminant analysis)、逻辑回归(logit regression)和非线性模型如神经网络等。奥特曼博士于1968年发表的Z-score模型基于多变量判别分析方法。

Z-score模型基于各变量加权得分对企业是否破产进行判断,在Z-score原始模型中,得分高于2.99的属于“安全”区域、低于1.80的属于“困境”区域,两个得分之间的属于“灰色”区域。

Z-score模型在美国企业如柯达、通用汽车的破产预测得到了很好的结果。

2. 本模块提供的 Zscore Model

下面我们从原理,模型公式,划分区间三个方面来简单介绍一下本模块中的两个Z-score模型:

2.1 All Corporate Bonds

模型原理

- No equity prices are needed

- Uses discriminant analysis methodology

- Coefficients are obtained from China distressed firm dataset from historical periods

模型公式

ZScore = 0.517 - 0.460*TotalLiabilities/TotalAssets

+ 9.320*NetProfit/0.5*(TotalAssets+TotalAssets[last])

+ 0.388*WorkingCapital/TotalAssets

+ 1.158*RetainedEarnings/TotalAssets

= 0.517 - 0.460*x1

+ 9.320*2/x2

+ 0.388*x3

+ 1.158*x4

划分区间

Z-score < 0.5: 已经违约0.5 < Z-score < 0.9: 有违约的可能性Z-score > 0.9: 财务健康,短期内不会出现违约情况

2.2 Corporate Bonds with Equity Listings

模型原理

- Uses Equity Prices: Information from equity set

- Uses discriminant analysis methodology

- Coefficients are obtained from China distressed firm dataset from historical periods

模型公式

ZScore = 0.2086*x1 + 4.3465*x2 + 4.9601*x3

x1: market value/book value of TotalLiabilities

x2: total sales/TotalAssets

x3: (TotalAssets-TotalAssets[last])/TotalAssets[last]

coef = [0.2086, 4.3465, 4.9601]

划分区间

Z-score < 1.5408: 已经违约Z-score > 1.5408: 财务健康,短期内不会出现违约情况

3. 如何实用本模块提供的 Zscore Model 接口

本模块目前提供了四个Z-score模型接口,分别如下:

3.1 zscore_ACB

---

Interface for calculating zscore using ACB.

parameter:

ticker[string]: ticker code

parameter[opt]:

begin[int]: year begin, default 2010

end[int]: year end, default 2014

coef[list of int]: coefficients for Zscore Model, default [0.517, -0.460, 18.640, 0.388, 1.158]

---

when success, will return factors and status code, as a dict;

when failed for some reason, will return error message and error code, as a dict;

---

Model ACB:

All Corporate Bonds

ZScore = 0.517 - 0.460*TotalLiabilities/TotalAssets

+ 9.320*NetProfit/0.5*(TotalAssets+TotalAssets[last])

+ 0.388*WorkingCapital/TotalAssets

+ 1.158*RetainedEarnings/TotalAssets

= 0.517 - 0.460*x1

+ 9.320*2/x2

+ 0.388*x3

+ 1.158*x4

coef = [0.517, -0.460, 18.640, 0.388, 1.158]

3.2 zscore_ACB_List

---

Interface for calculating zscore using ACB.

parameter:

ticker[list]: ticker code

parameter[opt]:

begin[int or list]: year begin, default 2010

end[int or list]: year end, default 2014

coef[list of int]: coefficients for Zscore Model, default [0.517, -0.460, 18.640, 0.388, 1.158]

---

3.3 zscore_ACBEL

---

Interface for calculating zscore using ACBEL.

parameter:

ticker[string]: ticker code

parameter[opt]:

begin[int]: year begin, default 2010

end[int]: year end, default 2014

coef[list of int]: coefficients for model, default [0.2086, 4.3465, 4.9601]

---

when success, will return factors and status code, as a dict;

when failed for some reason, will return error message and error code, as a dict;

---

Model ACB:

All Corporate Bonds with Equity Listings

ZScore = 0.2086*x1 + 4.3465*x2 + 4.9601*x3

x1: market value/book value of TotalLiabilities

x2: total sales/TotalAssets

x3: (TotalAssets-TotalAssets[last])/TotalAssets[last]

coef = [0.2086, 4.3465, 4.9601]

---

3.4 zscore_ACBEL_List

---

Interface for calculating zscore using ACBEL.

parameter:

ticker[list]: ticker code

parameter[opt]:

begin[int or list]: year begin, default 2010

end[int or list]: year end, default 2014

coef[list of int]: coefficients for Zscore Model, default [0.2086, 4.3465, 4.9601]

---

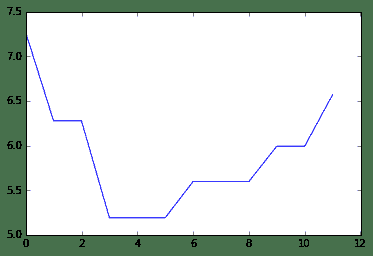

4. 一个 Zscore Model 实例

相关步骤说明如下:

- 4.1 导出该模块

- 4.2 输入股票代码,可选择性输入计算时间区间,以年为单位

- 4.3 得到计算结果

- 4.4 作图分析

# 4.1 & 4.2

GZMT = zscore_ACB('600519')

# 4.3

factors = GZMT['factors']

# 4.4

from matplotlib.pylab import plot

plot(factors['zscore'])

[<matplotlib.lines.Line2D at 0x4eda750>]

5. 本模块未来版本规划

为适应光大金融人士更加方便地使用 Z-Score Model,本模块将在以下几个方面对本模块的未来版本进行规划:

- 更加简单:提供上传模板,用户只需按照一定格式上传自己持仓的 excel 表格,即可在零编码的情况下得到相应持仓债券、股票发行人的 Z-Score 情况;

- 更加灵活:将会允许用户在我们定义的两个 Z-Score 模型的相关系数;

- 更加智能:预计提供给用户将近50个公司财务相关的因子,由用户自定义因子和相关的系数来计算 Z-Score 值;