[策略]基于胜率的趋势交易策略

来源:https://uqer.io/community/share/565bbfa4f9f06c6c8a91ae7a

策略说明

简单构建了一个基于胜率的趋势交易策略。认为过去一段时间(N天)内胜率较高、信息比率较高的股票会在紧随其后的几天有较好的表现

1)先根据胜率要求筛选出过去N天胜率高的股票作为预选股票(benchmark可以是定义的确定阈值,或者是某个指数相应的收益率),用aprior算法进行快速筛选。第i只股票胜率的计算方式如下:

winRate(i) = sum([sign(ret(i,t)-ret(bm,t))==1]/N)|t~(t-N,t)

*ret(i,t): i股票在第t天的收益率;

*ret(bm,t): benchmark在第t天的收益率;

2)从筛选出的股票中选择过去N天信息比率(收益率/波动率)高的部分股票构建备选投资组合; 3)依据被选投资组合做买入操作,使用可用资金的50%~70%; 4)设定股票止损位在收益下跌至0.95,止损时将仓位调整至原仓位的40%~60%; 5)调仓频率为5天,股票池为沪深300。

import numpy as np

from CAL.PyCAL import *

################################################################################

# Back Test Functions

################################################################################

def initialize(account): # 初始化虚拟账户状态

pass

####init the univese of the choosen stock

def universeInit():

stockComponent = DataAPI.MktTickRTSnapshotIndexGet(securityID=u"000300.XSHG",field=u"lastPrice,shortNM")

stockCount = len(stockComponent)

stockTicker = stockComponent['ticker']

stockExchgID = stockComponent['exchangeCD']

stockID = []

for index in range(stockCount):

stockID.append(stockTicker[index] + '.' + stockExchgID[index])

return stockID

####deal with the trading signals

def handle_data(account): # 每个交易日的买入卖出指令

####Presettings

histLength = 10

stockDataThres = 0

####Dictionary of the return Rate

closePrice = account.get_attribute_history('closePrice',histLength)

retRate = {}

for index in account.universe:

retRate[index] = ((closePrice[index][1:] - closePrice[index][:-1])/closePrice[index][:-1]).tolist()

###ret list of the benchmark

calendar = Calendar('China.SSE')

startDate = calendar.advanceDate(account.current_date,'-'+str(histLength)+'B').toDateTime()

benchmark = DataAPI.MktIdxdGet(ticker = "000300",

field = "closeIndex",

beginDate = startDate,

endDate = account.current_date,pandas = '1')

bmClose = benchmark['closeIndex'].tolist()

bmRet = []

for index in range(len(bmClose)-1):

bmRet.append((bmClose[1:][index]-bmClose[:-1][index])/bmClose[:-1][index])

####List of transactions

transactions = []

for index in range(histLength-1):

tmpt = []

for stock in account.universe:

if retRate[stock][index] > stockDataThres:

# if retRate[stock][index] > bmRet[index]:

tmpt.append(stock)

transactions.append(tmpt)

####List of hot stocks

hotStock = []

hotStockDict,hotStockList = apriori(transactions,0.95)

for index in hotStockList:

for stock in index:

if stock not in hotStock:

hotStock.append(stock)

####List of the portfolio

retRate = {}

fluctRate = {}

sharpRate = {}

for index in hotStock:

retRate[index] = ((closePrice[index][-1] - closePrice[index][0])/closePrice[index][0])

fluctRate[index] = np.std(closePrice[index])

sharpRate[index] = retRate[index]/fluctRate[index]

portfolio = [index[0] for index in sorted(sharpRate.items(),key = lambda sharpRate:sharpRate[1])[-len(sharpRate)/2:]]

####Stop loss at -0.05

validSecHist = account.get_attribute_history('closePrice',2)

for index in account.valid_secpos:

if (validSecHist[index][-1] - validSecHist[index][0])/validSecHist[index][0] < -0.05:

order_to(index,0.45*account.valid_secpos[index])

####Buy portfolio

for index in portfolio:

amount = 0.65*account.cash/len(hotStock)/account.referencePrice[index]

order(index,amount)

return

########################################################################################

# Aprior algorithm

########################################################################################

def elementsDet(datasets):

if type(datasets) == list:

elements = {}

for index in datasets:

for index1 in index:

if elements.has_key(index1) == False:

elements[index1] = 1

else:

elements[index1] += 1

return elements

if type(datasets) == dict:

elements = {}

for index in datasets:

if type(index) == tuple:

index = list(index)

for index1 in index:

if elements.has_key(index1) == False:

elements[index1] = 0

else:

elements[index] = 0

return elements

pass

def checkAssociation(subset,objset):

for index in subset:

if index not in objset:

return False

return True

pass

def support(subset,datasets):

count = 0

for transaction in datasets:

if checkAssociation(subset,transaction) == True:

count += 1

return 1.0*count/len(datasets)

pass

def apriori(datasets,minsup):

candidateIterator = []

electIterator = []

length = len(datasets)

##init part

#the candidate

elements = elementsDet(datasets)

candidate = {}

for index in elements:

candidate[index] = 1.0*elements[index]/length

candidateIterator.append(candidate)

#the elect

elect = {}

for index in candidate:

if candidate[index] > minsup:

elect[index] = candidate[index]

electIterator.append(elect)

##the update part

itera = 1

while(len(electIterator[-1]) != 0):

candidateOld = candidateIterator[-1]

electOld = electIterator[-1]

elementsOld = elementsDet(electOld)

# print elementsOld

candidate = {}

##the candidate

for index in electOld:

for index1 in elementsOld:

if type(index) != list and type(index) != tuple:

if index1 != index:

tmp = []

tmp.append(index)

tmp.append(index1)

tmp.sort()

if candidate.has_key(tuple(tmp)) == False:

candidate[tuple(tmp)] = 0

if type(index) == tuple:

tmp = list(index)

if tmp.count(index1) == False:

tmp1 = tmp

tmp1.append(index1)

tmp1.sort()

if candidate.has_key(tuple(tmp1)) == False:

candidate[tuple(tmp1)] = 0

candidateIterator.append(candidate)

##the elect

elect = {}

for index in candidate:

candidate[index] = support(index,datasets)

for index in candidate:

if candidate[index] > minsup:

elect[index] = candidate[index]

electIterator.append(elect)

# print 'iteartion ' + str(itera) + ' is finished!'

itera += 1

##the elected frequency sets dictionary: the value is the key's support

electedDict = {}

for index in electIterator:

for index1 in index:

electedDict[index1] = index[index1]

##the elected frequency sets lists

electedList = []

for index in electIterator:

tmp = []

for index1 in index:

if type(index1) == tuple:

tmp1 = []

for ele in index1:

tmp1.append(ele)

tmp.append(tmp1)

else:

tmp.append([str(index1)])

tmp.sort()

for index1 in tmp:

electedList.append(index1)

return electedDict,electedList

################################################################################

# Back Test Presetting

################################################################################

start = '2011-01-01' # 回测起始时间

end = '2015-11-01' # 回测结束时间

benchmark = 'HS300' # 策略参考标准

universe = set_universe('HS300')

# universe = universeInit() # 证券池,支持股票和基金

capital_base = 100000 # 起始资金

freq = 'd' # 策略类型,'d'表示日间策略使用日线回测,'m'表示日内策略使用分钟线回测

refresh_rate = 5 # 调仓频率,表示执行handle_data的时间间隔,若freq = 'd'时间间隔的单位为交易日,若freq = 'm'时间间隔为分钟

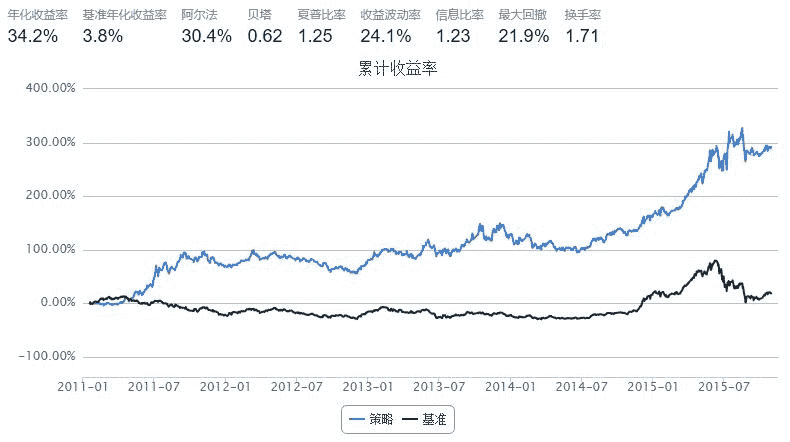

策略表现

- 策略能产生一定的alpha;

- 策略表现与起点强相关,sharpRatio不稳定;

- 策略表现会受到自身参数设定的影响,例如胜率选择周期、筛选阈值、调仓频率、建仓头寸、止损仓位等,需要依据表现对其进行优化;

- 策略在2011年4月至12月、2015年6月到11月有相对好的表现,可见其相对较适用于趋势下跌的市场环境。

问题探讨

因子选股模型的流程应该是怎样的?

小编认为构建因子选股的模型需要有如下过程:

- 大类配置:根据宏观判断市场,进行市场判断(根据不同市场选择不同因子)、资产配置(不同风险性证券的配比选择➡️不同热度的行业配比选择)和策略选择(市场中性、单边做多等);

- 选股-alpha端:对选股因子进行有效性分析,包括单因子的预测性、因子间相关性,构建多因子模型使得选股有尽可能高的alpha;

- 选股-风险端:对alpha端的多因子模型进行风险评估,根据风险因子优化模型,使模型尽可能达到有效边界;

- 择时-买卖时点:对根据因子模型选出的股票进行择时分析,进一步筛选投资组合中的股票及判断作何操作;

因子选股中比较basic的问题,欢迎社区的小伙伴们发表看法、评论和拍醒~